November 7, 2019 - There has been considerable discussion about the variants of SOFR on these pages (and at the LSTA Conference last week in the Introduction to LIBOR Cessation and SOFR Operationalization panels). Specifically we’ve discussed the pros and cons of SOFR Compounded in Advance and Forward Looking Term SOFR (Pros: Rate is known in advance and very easy to operationalize. Cons: Potentially stale (Compounded in Advance) and potentially non-existent (Forward Looking Term)). We’ve also discussed the pros and cons of SOFR Compounded in Arrears. (Pros: Perfectly hedgeable, the “real” rate, what other markets are doing. Cons: Rate is not known in advance and is quite complicated to operationalize.)

What we haven’t done is spent time discussing Simple Daily SOFR in Arrears (ie, taking the simple rate on a daily basis, but not compounding it). We rectify this oversight here (and in the COW).

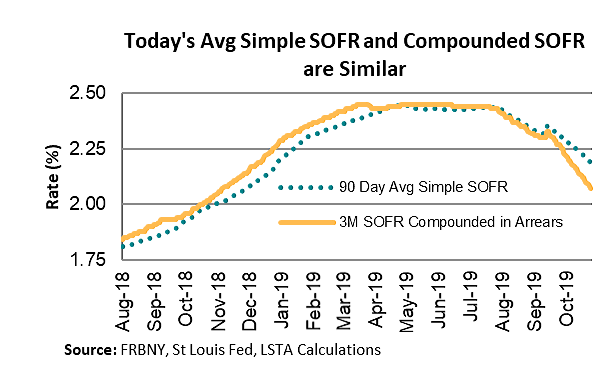

Like SOFR Compounded in Arrears, Simple Daily SOFR is not known at the beginning of the interest period, so many conventions would need to be changed or adopted. (See here for a short list.) However, operationally, Simple Daily SOFR in Arrears would be much, er, simpler. Many loan systems already have the ability to pull a daily rate, so that process would not change. Moreover, removing the issue of compounding greatly simplifies the operational build. As for how Simple Daily SOFR performs, the COW demonstrates that – at least in today’s low rate environment – Simple Daily SOFR is very similar to SOFR Compounded in Arrears. The question is “Is the market interested in a ‘simple’ solution?”