June 18, 2020 - Here’s a question you might have heard recently: Could CLO AAA notes be subject to significant and troubling credit losses? The short answer is “not really”. We offer a more detailed analytical answer below.

In reality, it would take incredible, prolonged and world-rattling levels of corporate defaults to actually create credit losses in CLO AAA notes. As one practitioner observed, if we got to the level of corporate defaults that significantly impaired CLO AAA notes, we’d already be living in caves. Let’s do the math.

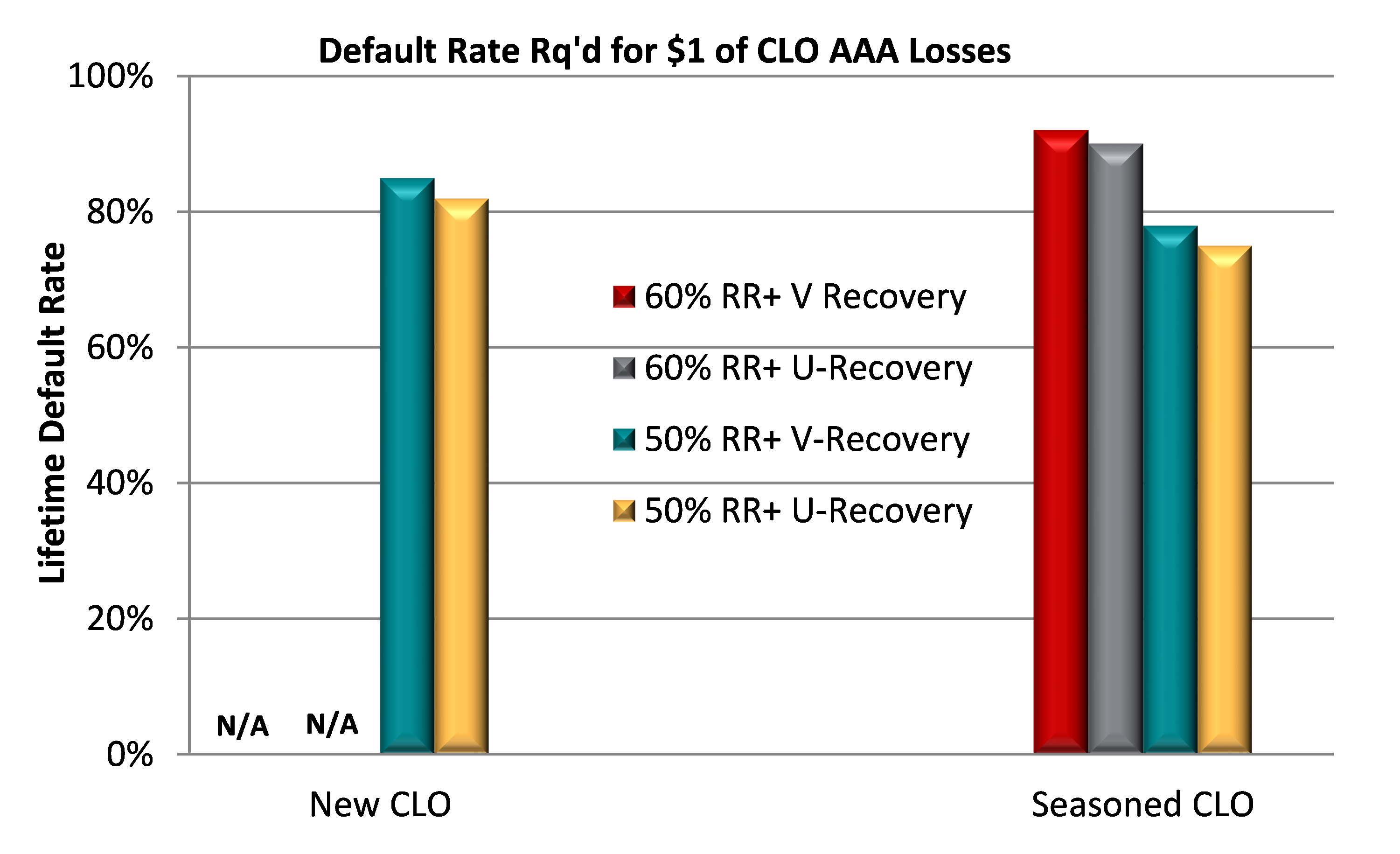

On April 17th, Moody’s published an article that focused on “collateral defaults’ effects on CLO notes”. To wit: It’s really hard to create principal losses on CLO AAA notes. To test this, Moody’s used one new and one seasoned representative CLO and tested loan default and recovery rates that would create first-dollar principal losses on AAA notes. They tested this using the current severe downturn and tested a V-shaped recovery and a U-shaped recovery.

Let’s start with a newly issued representative U.S. CLO issued in February 2020. If one assumes a 60% recovery rate given default on loans (down from this historical 77% recovery rate), there is no level of defaults that creates a principal loss for either a V-shaped or U-shaped recovery. (See COW.) If one assumes a 50% recovery rate – down 27 percentage points from the historical loan recovery rate – it requires an 85% lifetime asset default rate to create the first dollar of loss for a V-shaped recovery. For a U-shaped recovery, an 82% lifetime asset default rate is required.

For a seasoned CLO – in this case, issued in March 2015 – the default rates required to create a principal loss are a bit lower (but still absurdly high). Assuming a 60% recovery rate, it would require a 92% and 90% lifetime default rate to create one dollar of CLO AAA principal loss for a V-shaped and U-shaped recovery, respectively. For this seasoned US CLO, a 50% recovery rate would lead to the first dollar of loss at a 78% lifetime default rate under a V-shaped downturn and at 75% default rate under a U-shaped downturn. To put these numbers in perspective: 1) Moody’s expects today’s default cycle to play out more like a V-shape than a U-shape and 2) the 5-year cohort default rate – analogous enough to a lifetime default rate – for US single B rated issuers hit 50% in the Great Depression.

So, if the Great Depression wouldn’t break a representative CLO AAA tranche, what could? In late March, Moody’s published three default scenarios, including an extremely severe recession scenario (which Moody’s thought was highly unlikely). In the extremely severe scenario, which would be significantly worse than the 2008 Financial Crisis, the U.S. default rate would peak at 22% in early 2021. So how many years would it take an annual 22% default rate to create a 92% lifetime default rate in a CLO portfolio? (Hint: It’s not 92%/22% because the performing loan portfolio shrinks every year.) While the math is a bit more complicated, a back of the envelope approach suggests that, starting with a 100% performing portfolio at the beginning of 2020, in a constant 22% default rate scenario, a CLO portfolio would not hit a cumulative 92% default rate until sometime in 2030. Considering the diversity of the loans in a CLO – they really reflect the diversity of Corporate America – and the fact that Moody’s has since moderated its peak baseline US default rate to about 12%, it’s extremely hard to see a situation where CLO AAA notes suffer significant principal losses.