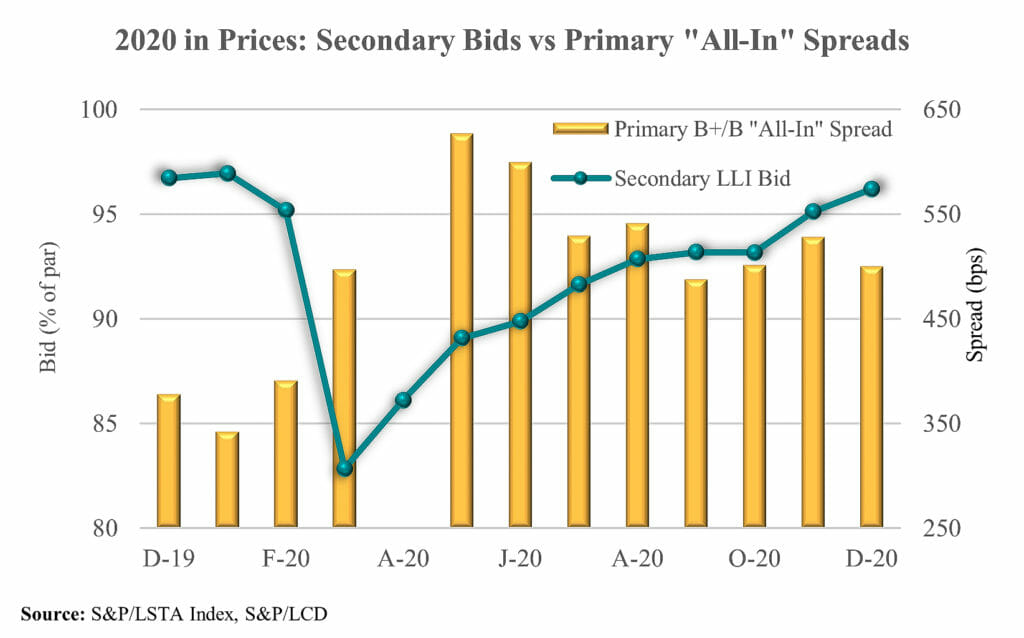

January 7, 2021 - If surveyed at 20,000 feet, the 2020 US leveraged loan market did not look too bad: At $288 billion, institutional lending was off just 7% from 2019 levels, according to S&P/LCD. While investment grade lending was down by 36% – to $606 billion – according to Refinitiv, the $1.86 trillion in corporate bond issuance may have more than made up for that. The average price in the S&P/LSTA Leveraged Loan Index (LLI) ended the year at 96.19, down 53 bps from the year-earlier level. All-in new issue spreads (including OID and LIBOR floor benefit) for B+/B loan ended 2020 at 500 bps, admittedly up from 378 bps a year earlier. But a good amount of this “spread increase” was due to LIBOR floors; the YTM of B+/B loans was 5.2% at year-end 2020, down 50 bps from a year-earlier.

But, of course, a lot happened in the intervening 12 months, with the loan market enduring four stages in 2020: i) Opportunism, ii) Collapse, iii) Recovery and iv) Opportunism Redux. These phases can be seen in lending volumes, primary and secondary pricing, loan purposes and loan documentation.

January 2020, if one can remember back that far, was one hot month. Institutional lending volumes topped $64 billion, the average all-in spread on B+/B loans was 342 bps, according to LCD, and the average price in the LLI topped 97. Meanwhile, downward flexes outpaced upward ones 38:3, according to Leveraged Finance Insights (LFI).

Of course, Covid-19 was lurking, softening the secondary market by nearly 2 points in February and then walloping it in March. As discussed in the LSTA Secondary Review and demonstrated in the COW, secondary loan prices plunged 19 points to a 76 handle by late March as funds sold positions to meet redemptions and CLOs preemptively exited loans heading south (credit-wise or ratings-wise). Institutional lending stopped on a dime and, consequently, primary pricing stats were irrelevant. While market eulogies were being drafted, the Fed stepped in and flooded markets with money and puts. Though other markets were the direct beneficiaries of Fed largesse, the loan market also stabilized.

Once the rapid-fire selling stopped – and there were indications that many companies had drawn down and locked in liquidity – recovery replaced rout. Secondary prices rebounded more than six points in April and May combined. New issues were limited and were largely rescue financings, so volumes remained low ($20 billion combined for the two months) and all-in spreads remained in the 600 bps context. But lending returned more seriously – with $25 billion in new loans – in June.

The tone began to shift from recovery to opportunism in final months of the year. In fourth quarter, average CLO AAA spreads tightened 24 bps, the arbitrage improved, and CLO issuance topped $30 billion for the first time since 2Q19. Stronger investor demand created more opportunities for borrowers. LBO lending doubled between third and fourth quarter, hitting $21 billion. And after sitting near zero, dividend lending topped $15 billion in third quarter and $17 billion in fourth quarter, says LFI. Meanwhile, Refinitiv tracked 35 borrower friendly structural or price flexes in December.

And as for document trends? After tightening mid-year, LFI noted that 29% of all loans and 36% of PE loans were rated an aggressive 4- or 5+, up from 22% and 25%, respectively, a quarter earlier. But there was somepush back on the “Serta Simmons” provisions, whereby lax voting language resulted in a number of lenders being primed by a superpriority tranche. At least 14 4Q20 deals tightened language around voting subordination of payment priority and 37% of 4Q loans required subordination to other debt to be supported by all lenders or affected lenders, up from less than 6% in 3Q20.

While the first days of 2021 have not been lacking in drama, here is to a hopefully calmer New Year.