June 9, 2022 - On June 8th, the LSTA and Sidley Austin held a joint Private Credit Seminar in Chicago. On this week’s panel – and below – we tackled the $64 trillion question: Just how big is Private Credit. And next week, we’ll dive deeper in the LSTA/DealCatalyst Middle Market CLOs and Direct Lending Conference.

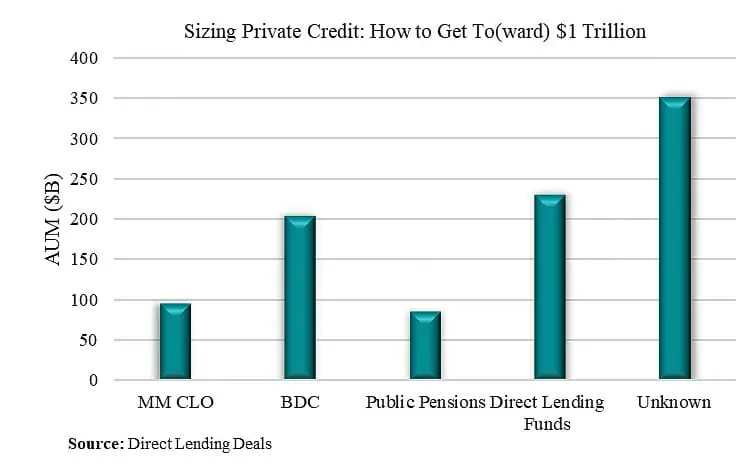

The panel first sought to measure the size and growth of the private credit market. Slide 5 of the presentation, courtesy of Refinitiv, compares middle market sponsored syndicated lending (left) with middle market sponsored direct lending (right). What’s clear: Syndicated lending is flat, while middle market sponsored direct lending is increasing substantially. Importantly, this growth rate excludes the 20-plus jumbo unitranche deals recently sighted (and detailed in the appendix). A precondition to soaring dealflow is robust fundraising: $60 billion of middle market fundraising was seen in fourth quarter 2021 alone (slide 6). And thus, the eternal question: How much private credit debt is outstanding? Conventional wisdom posits that there’s about $1 trillion of private credit AUM (including leverage) invested in loans. But aside from a tummy test, how do we get to $1 trillion? Direct Lending Deals (DLD) employs a more analytical approach. As the COW (and slide 8) demonstrate, DLD tracks $96 billion of middle market CLOs (courtesy of Refinitiv), $204 billion of BDC AUM (from public filings of public and private BDCs), $86 billion of public pension fund allocations (according to PublicPlansData.org, US plans manage $4.5 trillion in assets with 1.9% in misc. alternatives, which likely include private credit) and $230 billion in Direct Lending Funds (which reflects Preqin Pro’s fundraising numbers since 2015). All told, this brings “Known(ish) Knowns” to roughly $616 billion. To that, DLD thinks that another $350 billion of “Known Unknowns” might be reasonable. This catchall includes private pension funds, endowments, insurance companies, family offices, high net worth individuals, SMAs and sovereign wealth funds. And that is how one totals up (nearly) $1 trillion in private credit.