June 16, 2022 - On Wednesday, the LSTA, DealCatalyst and some 700 registrants launched the inaugural Middle Market CLO and Direct Lending Conference at Chelsea Piers. Below, we quickly recap some key ideas and takeaways. Registrants that missed the live event can access the presentations here; folks that forgot to register can do so at a discounted rate here to attend the recorded sessions.

A Little Perspective: LSTA Executive Director Lee Shaiman welcomed the crowd to the event, reminding them (à la Jonathan Swift) that “Everything old is new again”. What’s new (and old) is Private Credit. Indeed, the rootstock of the $1.4 trillion leveraged BSL market comes from private credit provided by non-bank lenders. Direct Lending or Private Credit may just be a new means to provide debt from investors (often the same as those in the BSL market) to borrowers. And many of the challenges in Private Credit space are the same as in the BSL space. For instance, standards, documentation, financial technology, LIBOR remediation, bankruptcy reform, ESG regulation and disclosure and Private Funds Disclosure Rules affect loans and lenders, whether in a BSL or a Private Credit wrapper.

Putting Private Credit in Context: Interest and appetite for private credit has been on the rise since the global financial crisis. Banks and mainstream financial institutions were hamstrung by increased regulation and restricted by internal aversion to risks associated with leveraged credit, creating an opening for private lending, particularly to mid-market sponsored leveraged buyouts. The key for managers is marrying good credit skills with the ability to source and originate consistent deal flow – and then securing long term or permanent capital. But permanent capital vehicles also need to use financial leverage to generate the returns that investors require to lock that capital up, with limited or no liquidity. An efficient way to do so is the middle market CLO. For direct lenders, CLOs are part of their lending business; they are not solely an arbitrage opportunity or a way to grow AUM. This makes MM CLO management and direct lending very different from those who focus only on BSL. While both require strong credit cultures and a knowledge of structured finance, the ability to originate and deploy cash with a regular cadence while sustaining a strong track record critical for successful direct lending platform.

Market Volatility & Private Credit. Panels throughout the day considered the impact of global markets volatility. Middle market CLOs and private credit managers generally intend to hold assets to maturity, which can temper the short-term swings in valuations felt in the BSL market. In addition, while many managers employ leverage or warehouse facilities, they usually avoid “mark-to-market” leverage. Still, many direct lenders use third party valuations (usually on a “mark-to-credit” basis) on a quarterly basis which can introduce some volatility into NAVs – but not nearly the volatility seen in mark-to-market BSL portfolios. The broader market volatility that has leaked into the middle market means that “while pencils are not down, maybe they are sideways.” Lenders are pausing as they consider the impact that economic volatility has had on asset valuation, the level of stress a CLO warehouse structure can take, as well as any increased cost of any warehousing or financing. As for financing costs, an audience poll suggested it likely increased by 10-30 bps in recent months.

Evolving Investor Base. Who are the investors, what are they trying to achieve, what can they expect from investing in Private Credit (and in what form)? Speakers noted that insurance companies and pension funds have rotated out of high yield and into Private Credit in recent years. Why? These investors are matching the duration of their payouts, meaning they generally are more focused on credit – and quarterly coupon payment – than daily liquidity. With a bit of leverage, funds can see Private Credit returns in the high single digits to low teens with little NAV volatility. Investors are using investment structures ranging from middle market CLOs (with a “tight box” of rules, less manager discretion and higher ratings) on one end to rated feeder funds (with fewer rules, more manager discretion and ratings topping out at – or below – single A) on the other.

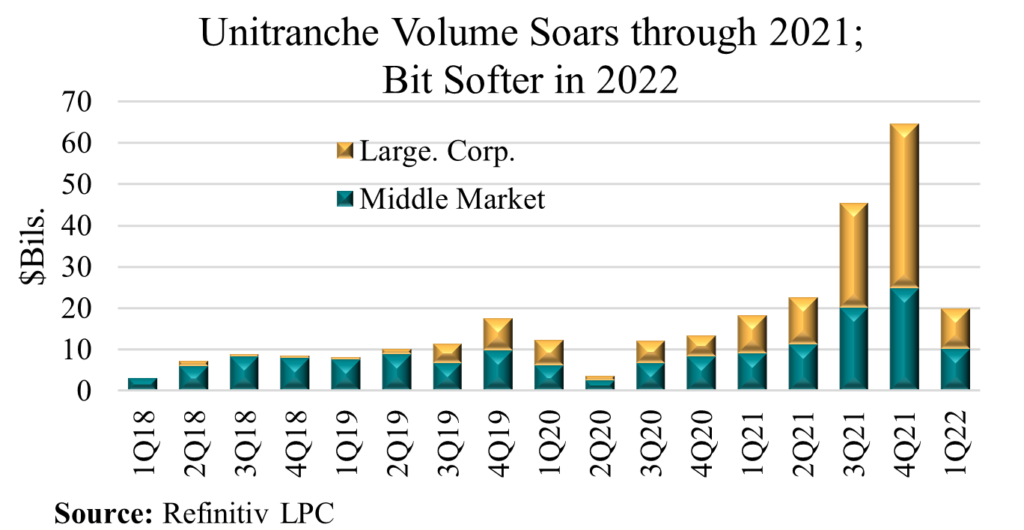

A Tale of Two Private Credit Markets. Speakers pondered the tale of the (alleged) two markets in Private Credit. On the one hand, there is the traditional, middle market-y direct lending that really focuses on smaller companies. Theoretically, this market relies on strong sponsor relationships, strong loan documents (including a maintenance covenant) and a tight affiliation between a few long-time lenders. On the other hand, there are the deals that are BSL – Broadly Syndicated Loans – in structure, if not in distribution methodology. These tend to comprise the $1 billion-plus unitranches that are clubbed up by the giants in the space. Such loans have been on a tear recently, with nearly $40 billion of large corporate unitranches in fourth quarter 2021, before the market softened in 2022 (see COW). Long-time lenders fret that these jumbo private credit transactions may have some of the drawbacks of BSL loans (like looser documents and limited covenants). However, others note that – at least until the recent pullback – many of the BSL loan terms had begun entering the true middle market private credit space.

Defaults & Performance: In the pandemic, the middle market sector witnessed a higher level of defaults and generally lower recoveries than the BSL market, panelists said. But lenders weathered the storm as an enormous amount of capital offered stability to most borrowers and defaults remained well below financial crisis heights. Private credit rallied back during the latter half of 2020 and across 2021 as the number of market participants expanded and competition became heated. Today, lenders are becoming more conservative as the spread differential between the middle market and BSL market tightens. Still, middle market borrowers remain well capitalized and speakers did not expect default rates to rise meaningfully until 2023/2024.

Regulation & Policy: Many of the regulatory and policy challenges faced by the BSL market extend into the Private Credit space as well. In recent years, the macroprudential regulators – such as the Fed, Financial Stability Board and FSOC – had evidenced concern that leveraged loans, CLOs and other areas of “shadow banking” (including private credit) could create systemic risk. These sectors performed relatively well in the pandemic (and were at least partially exonerated by the GAO). Now the macroprudential focus seems to be increasingly on Non-Bank Financial Intermediaries such as open end funds and money market funds, which regulators believe could be subject to runs. However, the SEC is becoming increasingly normative and focused on private markets. This appears in SEC’s private funds disclosure rule, which would require far more financial reporting and audits while prohibiting certain normal business practices such as indemnification. The rule captures both BSL and Middle Market CLOs (which may have a way out), as well as Commingled Funds and SMAs in “Funds of One” format (which may not have a clear way out). The SEC’s focus on ESG disclosure is another area that hits Private Credit as squarely as the BSL space. The SEC recently proposed rules on ESG disclosure for registered funds and investment advisers. In effect, if a fund – or an adviser – includes any consideration of ESG in its investment process, it will be subject to new disclosures and reporting to the SEC. (The LSTA has begun analyzing and will be commenting on this rule.)

ESG: What should the middle market expect to see as ESG remains a top priority for many asset owners (some of whom are investing more in the middle market and private credit generally)? Sustainability linked loans – where borrowers are incentivized to improve their sustainability profile measured against selected, material KPIs – are becoming more common in leveraged lending, financing for PE sponsors, and are finding their way into CLO holdings. ESG is also appearing in documentation where BSL CLO indentures increasingly restrict the manager from investing in companies whose revenues primarily come from activities such as thermal coal, tar sands and arctic drilling, weapons, opioids and predatory lending (to name just a few). These restrictions now can be triggered even when the activities contribute a fraction – sometimes 25% or even just 10% – of a company’s revenues. These developments shine a light on the need for better and more comparable ESG data in private markets. Building on the successful uptake of the LSTA’s ESG DDQ for borrowers, the LSTA, the ACC and the UN PRI are leading a ESG disclosure harmonization project. This project looks to advance the availability of quantitative, comparable ESG data through creating a more efficient and clear process for borrowers. It behooves market participants to get behind these market-driven efforts. Greenwashing risks have never been greater – the SEC’s scrutiny of ESG investing has already led to enforcement actions and the proposal of ESG disclosure requirements for RIAs and registered funds emphasizes the SEC’s focus.

The LSTA and DealCatalyst would like to thank the 30 sponsor firms and hundreds of attendees for making this inaugural event such a success.