September 15, 2022 - What is the future of the corporate loan market? As the Broadly Syndicated Institutional Loan (“BSL”) market has gyrated – mostly downward – in 2022, a number of would-be syndicated loans have been replaced by private credit jumbo unitranches. This has increased speculation about the interplay of the BSL and private credit markets going forward. Will they be competitors? Will private credit eat BSL’s lunch – or fade away? Alternatively, will the markets coexist peaceably – even symbiotically? We discuss briefly below and in detail in “The Rise (and Rise) of Private Credit” panel at the LSTA Annual Conference next week.

The first question: What is the relative size of the two markets? Lenders have long tried to size the private credit market, recently settling on “approximately $1 trillion.” Direct Lending Deals (“DLD”) may have deconstructed this number best, identifying roughly $100 billion in MM CLOs, $200 billion in BDC AUM, $86 billion in public pension fund assets and $230 billion in direct lending funds. DLD has another $350 in “unknowns”, which includes private pension funds and endowments, insurance companies family offices, HNW individuals and SWFs. While much of the market has coalesced around $1 trillion and change, a recent Proskauer private credit client survey suggests AUM might be closer to $2 trillion. (More on this next week!)

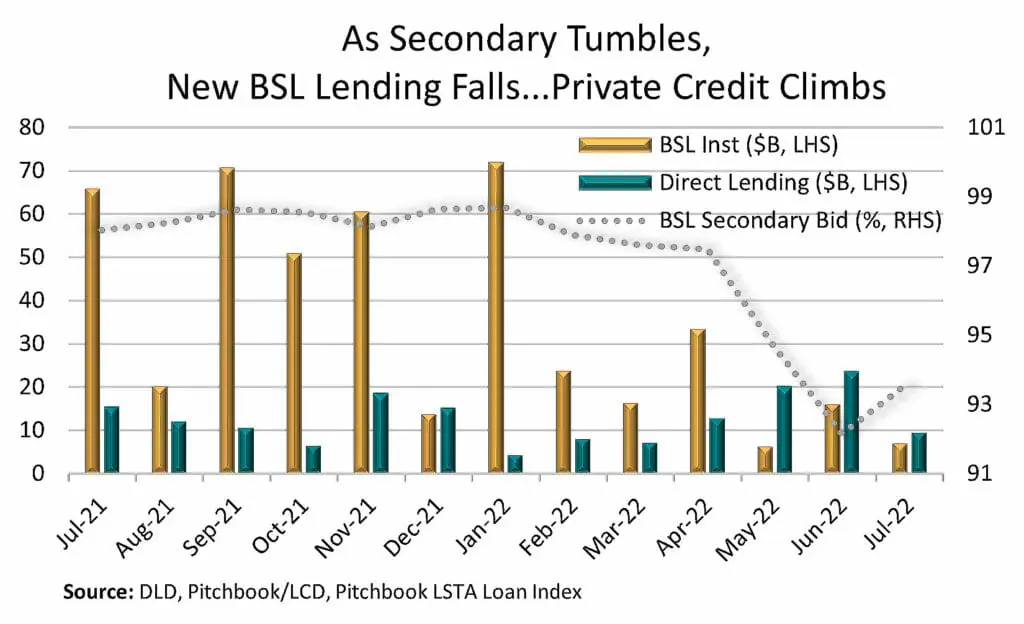

While size is eye-catching, a more foundational question may be, “Will private credit play nicely with BSL?” Earlier this year, private creditors had the opportunity to originate vast sums of new loans, while helping ease pressure on a largely hung BSL pipeline. The COW considers these trends. The BSL market came into 2022 with a substantial deal pipeline. And all went well. Through January. However, with the invasion of Ukraine, surging inflation (and interest rates) and continuing supply chain challenges, things deteriorated quickly. As secondary (BSL) loan prices fell from nearly 99 in mid-January to less than 92 in early July, clearing yields in the primary gapped and left underwriters underwater on billions of dollars of deals. Helpfully, the private credit market was able to step in and do multi-billion underwritings. DLD reports that, by their yardstick, direct lending jumped by 188% in second quarter. (LCD adds that private credit was not only replacing BSLs, but also stood in for some high yield bonds, such as a $2.15 billion second lien replacing Nielsen’s bond offering.) While the BSL market may not have stabilized yet, without the private credit release valve, it might be much worse.

But private credit is not immune to market volatility either. DLD reports that, after approaching $10 billion for two consecutive months, jumbo unitranche financing dried up in July. Spreads already had begun widening and leverage already was tightening. Meanwhile commitment size is shrinking and one can expect smaller “Jumbos” in the coming months. Refinitiv concurs, noting that “debt funds are writing smaller checks” and repayment protections and covenants are trending in lenders’ direction.

Still, the ebbs and flows of a market are a cyclical thing. The issue that may interest long-sighted lenders the most is, “What will these markets look like in the future?” In the short term, we may be staring down the barrel of a recession. How will smaller companies in private credit fare relative to their larger BSL-financed brethren? Will the reputedly better relationships and documentation of the direct lending space lead to better outcomes, even if smaller companies struggle more in a downturn. And in the longer term, can the BSL and private credit markets coexist peaceably – perhaps even symbiotically? Or must market win and the other lose? We will be discussing all these matters at the LSTA Annual Conference – and we hope to see you there!