April 13, 2023 - Despite the recent banking turmoil, LIBOR transition activity actually is accelerating. That said, while legacy loans are proactively switching to SOFR via fallback amendments, CLO LIBOR transition is moving a bit more slowly. In a recent video by the LSTA’s Tess Virmani, Meredith Coffey and Paul Hastings’ Nicole Skalla, we discussed the LIBOR transition process and the decision points for CLOs. (We also reiterated – as covered here – that synthetic USD LIBOR largely is not a solution for US law governed contracts.)

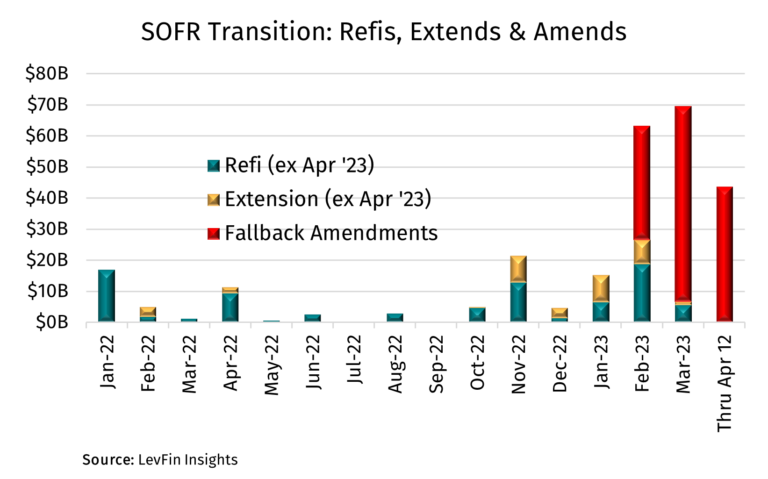

First, according to LevFin Insights, while LIBOR transition via “organic” loan refinancing activity slowed in March – no surprise considering the SVB/Signature Bank/Credit Suisse turmoil – observed amendment fallback activity nearly doubled to $63 billion last month. And the pace of amendments is only accelerating. According to LFI (with some back of the envelop additions), there were another $45 billion of observed LIBOR transition amendments through April 12th (see the nearby COW).

So that’s great for loans – but how does this translate to CLOs? According to a JPM SOFR Transition update, roughly 34% of the loans in CLOs are on SOFR (up 8% since the prior month) and roughly 20% of CLO notes reference SOFR. If that seems low, be advised that the data reporting is a bit lagged. In fact, if $100 billion of observed LIBOR fallback amendments have gone through since these stats were captured, and a pro rated $69 billion of them are in CLOs, then the share of CLO loans referencing SOFR is probably closer to 40%.

However, CLOs generally would not transition early until 50% of their collateral is on SOFR (the “Asset Replacement Trigger”). Since we’re not there yet, how will CLOs shift to SOFR? Most will transition around June 30th using their contractual fallback language. But for those that do not, the U.S. LIBOR Act is largely the solution, not synthetic LIBOR. On Slide 11 (starting at 19:30), Paul Hastings’ Nicole Skalla walked through a “LIBOR Act Decision Tree for CLOs”, which determines whether a CLO would transition through its own fallback language or through the LIBOR Act. While we describe the decision tree below, the detailed visual on slide 11 is highly recommended.

- First, does the indenture have fallback provisions? If the answer is no, then the contract automatically transitions to CME Term SOFR+ARRC CSAs on the LIBOR replacement date.

- If the answer is yes, does the fallback have a specific non-LIBOR based benchmark replacement? If yes, the CLO transitions according to the terms of the contract. If no, the next question is whether there is a “Determining Person” (“DP”).

- If the answer is no, then the contract automatically transitions to CME Term SOFR+ARRC CSAs on the LIBOR replacement date. If yes, then the next question is whether the DP has selected a replacement rate by June 30, 2023.

- If the answer is no, the contract automatically transitions to CME Term SOFR+ARRC CSAs on the LIBOR replacement date. If yes, the contract transitions to the selected replacement rate at the date the determining person selects a benchmark replacement.

We ended with a series of CLO Manager Next Steps including, (i) reviewing their indentures (we offered review tips) and consulting with their counsel; (ii) reaching out to trustees and collateral administrators to confirm approach on LIBOR remediation; (iii) for CLOs with adequate fallback provisions, preparing the notices and amendments and having them reviewed (and signed off on) by the CLO issuer and trustee ASAP; (iv) for CLOs falling under the LIBOR Act, confirming that trustee agrees with the manager’s analysis and confirm whether trustee expects to send a notice of the transition.

Bottom line: There’s a lot of CLO wood to chop, but there’s a path through the trees.