September 13, 2023 - LIBOR transition – remember that?! – took the loan market a painful six years to complete. Aside from dancing on LIBOR’s grave, today we look at where we stand and remind members to send any remaining questions to LIBORinformation@lsta.org. We’ll address them on our next-to-last LIBOR Q&A Call at 3PM(ET) on Monday, September 18th.

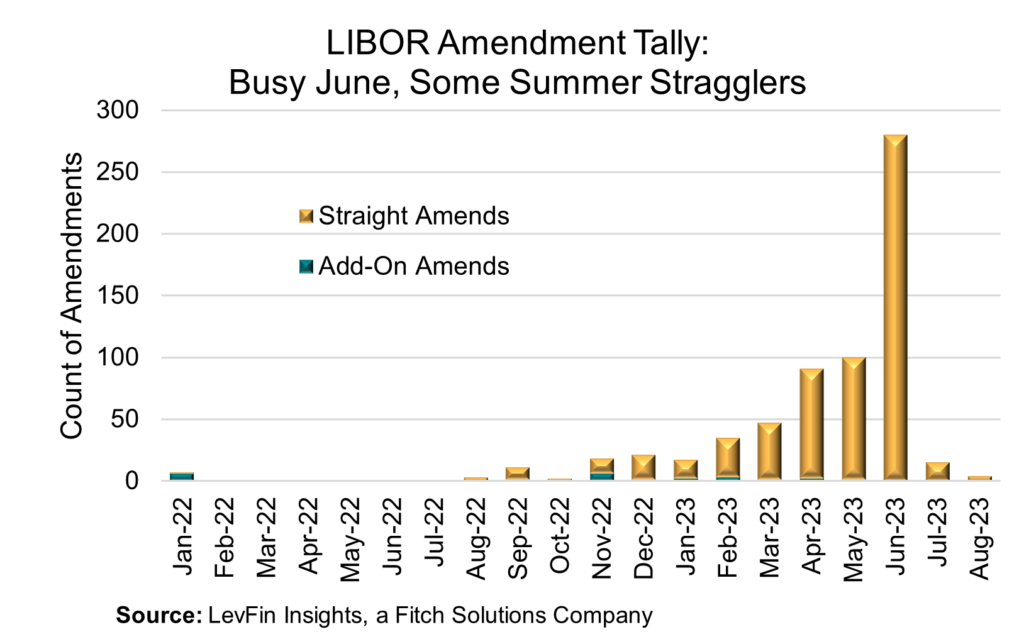

First, getting across the finish line required a remarkable amount of work. As the COW demonstrates, LevFin Insights publicly tracked more than 600 LIBOR transition amendments between late 2021 and now. (And there assuredly were many more that flew under the radar.) The amendment data fall into two categories. First, there were “add-on” amendments (green), where a company switched from LIBOR to SOFR in the ordinary course of doing an amendment. These were relatively few and far between – at least publicly – and tended to be clustered in earlier months. The other category were “straight” amendments, which were the pure LIBOR fallback amendments (yellow) developed in coordination with the ARRC. These were rare prior to 2023, partly because documentation had been evolving and partly because market participants (other than those directly involved in LIBOR transition) had not yet developed a sense of urgency. However, LIBOR fallback activity accelerated sharply, peaking at nearly 300 (publicly visible) amendments in June 2023. LevFin Insights also tracked more than $30 billion of loans that are using synthetic LIBOR. (We remind gentle readers that synthetic LIBOR is simply Term SOFR + ARRC/ISDA Credit Spread Adjustments (“CSAs”).)

So how deeply into SOFR world have the leveraged loan and CLO markets ventured? According to JP Morgan, as of the August end, 76% of the loans in the JP Morgan loan index are referencing SOFR. In the CLO space, they see 99% of floating rate CLO liabilities referencing SOFR. (Clarification: Many CLOs transitioned at the end of June but because they have three-month interest periods, most will reference LIBOR until late third quarter or fourth quarter this year.) All told, this seems like progress.

But how can we keep the process moving smoothly? Our colleague Ellen Hefferan offers some operational tips. First, as we approach quarter end, agents should help lenders have visibility into each interest rate component by utilizing the individual fields in their interest rate and rollover notices to separately depict (i) Reference Rate (SOFR), (ii) CSA, (iii) Margin and (iv) All-in-Rate. In a SOFR world, many managed portfolios’ indentures require that the Weighted-Average-Spread tests separately depict Reference Rate (SOFR) / CSA / Margin / All-in-Rate. If agent banks have not configured their notices to separate the CSA from the reference rate (or state explicitly that the CSA is 0.00 and then incorporate it into the reference rate value), it has been necessary to manually review the portfolios each month to separate the two rates to generate CLO compliance reports. Further, the use of Optical Character Recognition (OCR) technology has been negatively impacted by including CSAs as part of the reference rate. The OCR technology is used to read notices and rollover contracts and combining the ‘implied’ CSA rate with the reference rate creates misinformation.

Bottom line: Help us help you! Agents, please ensure that all your notices separately depict (i) the Reference Rate (SOFR), (ii) CSA , (iii) Margin and (iv) All-in-Rate.