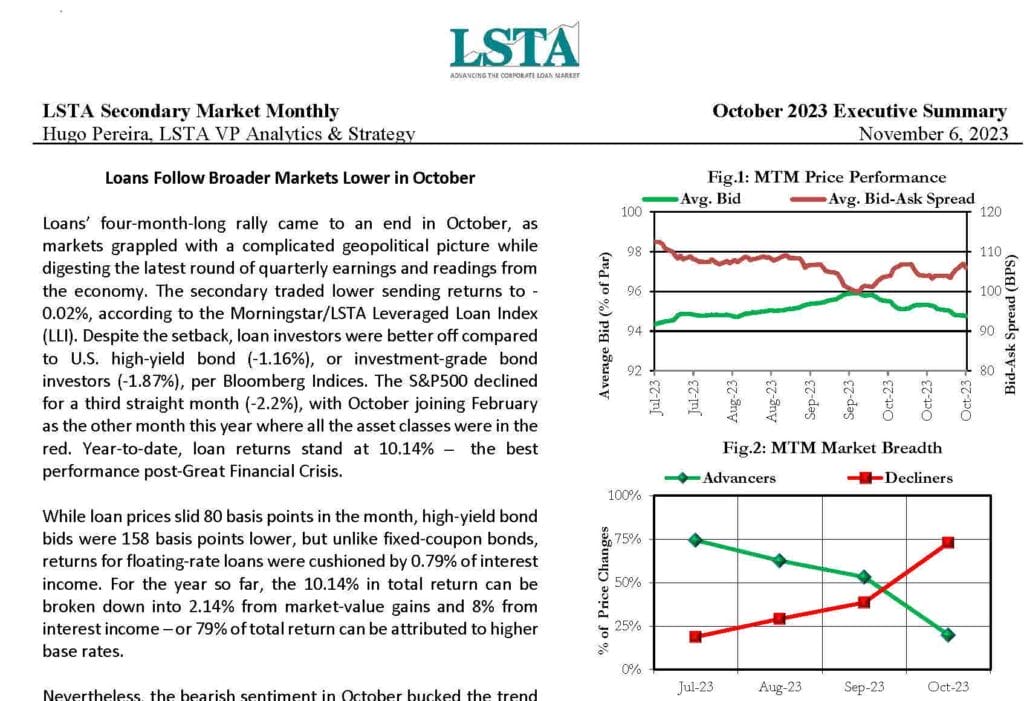

Loans’ four-month-long rally came to an end in October, as markets grappled with a complicated geopolitical picture while digesting the latest round of quarterly earnings and readings from the economy. The secondary traded lower sending returns to -0.02%, according to the Morningstar/LSTA Leveraged Loan Index (LLI). Despite the setback, loan investors were better off compared to U.S. high-yield bond (-1.16%), or investment-grade bond investors (-1.87%), per Bloomberg Indices.

| File | Secondary-Market-Monthly-October-2023-Executive-Summary.pdf |

|---|