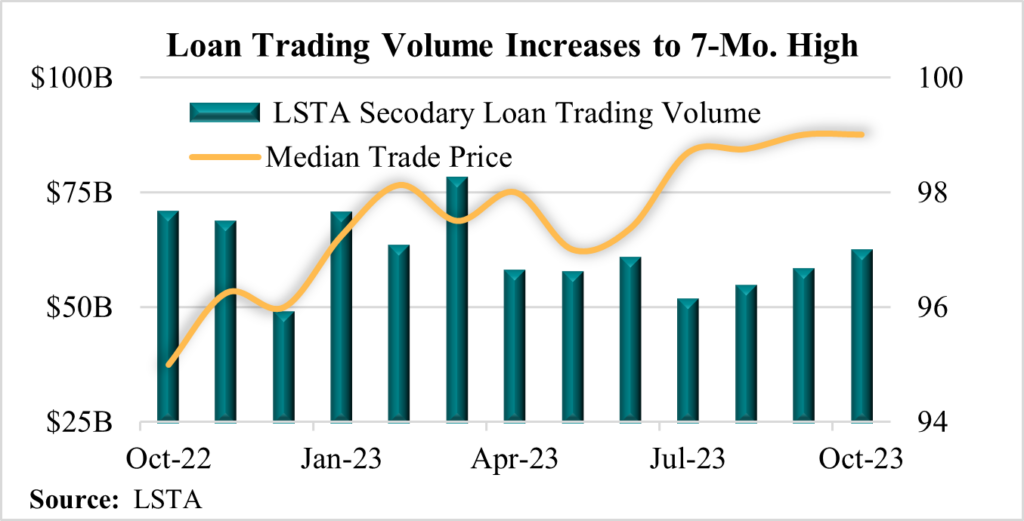

November 27, 2023 - Year-to-date through October, secondary loan trading volume remains 13% off last year’s run rate for the same period. However, monthly volumes have picked up since bottoming out at just $51.4 billion in July. Since that time, monthly activity has steadily increased, with October’s reading hitting a seven-month high of $62.2 billion – an increase of 7% over September. That said, with 10 months of trade data in the books, 2023 secondary activity projects to a five-year low of $736 billion on an annualized basis, or a 12% decline from 2022’s all-time high.

In October, an increase in secondary market volatility drove volumes higher alongside a noteworthy rise in market breadth. The number of distinct loans traded increased above 1,500 for the first time since May (coincidently the last time that the Morningstar/LSTA Leveraged Loan Index (LLI) reported a monthly market-value loss). The LLI recorded a -0.8% market-value loss, whereas the average monthly trade price fell just 10 basis points to 96.4 (the second-highest reading since April of last year). At the same time, the median trade price remained flat at its 19-month high of 99, illustrating the flight to quality trade that ensued across the secondary. We highlight the flight to quality effect on the market’s bid-ask spread: Despite October’s negative reading, the median bid-ask spread tightened six basis points to 63 basis points (also a 19-month best).

Furthermore, a new trend emerged in the secondary, with the higher priced (and rated), end of the market becoming more active. As traders chased higher quality loans, 61% of October trade activity transacted above 98, whereas the 98-and-above cohort of loans comprised just 55% of loans outstanding. The subset of loans trading above par totaled 8% of secondary activity as compared to 5% of loans outstanding.

Traders also continued to concentrate on the lower end of the market in October, with loans trading in a sub-90 context constituting 14% of trading volume, one percentage point above their share of loans outstanding. Given the heightened concerns around credit quality this year, it should come as no surprise that the stressed segment of the secondary (loans trading in a sub-90 context) has continually garnered a higher share of trading volume than their share of outstandings. But over the past several months, those percentages have moved more in line with each other as the pace of rating downgrades relative to upgrades has declined considerably. To that point, the ratio of rating downgrades to upgrades (on a rolling three-month basis) fell to a 16-month low of 1.6:1 in October, after falling below a ratio of 2:1 in August.