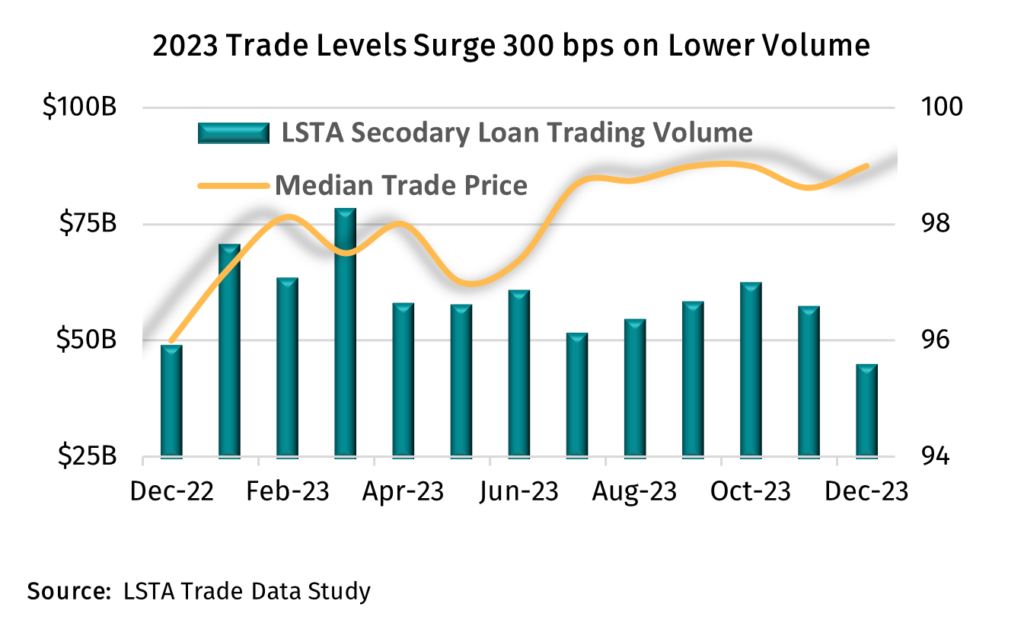

January 24, 2024 - According to the LSTA’s 4Q23 Trade Data Study, secondary loan trading volume in 2023 fell 13% to a six-year low of $715 billion. While par volume declined 14% to $697 billion, distressed volume, which accounted for only $18 billion in activity, surged 33% as the default rate increased from 1.6% to 3%, according to Fitch. Looking back, first-quarter trading activity spiked to $211 billion on heavy volatility in the secondary. However, after the impressive start to the year (the third busiest on record), secondary activity dropped substantially following the banking crisis which began in March. Second quarter volumes fell 17% to $176 billion – marking the first sub-$180 billion quarter in two years. Continuing this trend, secondary volumes fell to three-year lows of $164 billion in the third and fourth quarters, respectively. But despite the lower volumes reported across the last three quarters of the year, monthly market breadth (i.e., the number of distinct loan facilities traded) from April through December fell by just 2.5% to an average of 1,472 loans.

So why did secondary volumes fall so hard and fast in 2023? On the demand side, BSL CLO issuance fell 24% year-over-year, to $88.4 billion. Additionally, an estimated 40% of existing CLOs were operating outside their reinvestment period by the end of year. Furthermore, monthly flows from loan funds (mutual funds and ETFs) were lower in 2023 on an absolute basis (i.e., ignoring the direction of the flows). In 2022 absolute fund flows averaged $5.5 billion per month compared to just $1.8 billion in 2023 – a large difference considering the effect of retail forced selling (or buying) on aggregate trade activity. That said, AUM fell $17.5 billion in 2023 as compared to $12.1 billion in 2022. Finally, on the supply side, M&A’s share of total institutional lending declined to a post-Global Financial Crisis low of 30% — limiting the ability of loan traders to actively search out relative value trades via an active new issue market.

Still, all was not lost during 2023: The Morningstar/LSTA Leveraged Loan Index (LLI) posted a post-crisis best 13.3% return as base rates surged to near-record levels. To close out, there is a lot to be encouraged about as we contemplate what’s next for the market in 2024. Firstly, secondary trading levels reached two-year highs by the end of December, with the average and median trade prices increasing more than 300 basis points on the year, to 96.35 and 99, respectively. Secondly, the LSTA/LSEG MTM median bid-ask spread on the traded universe of loans continued to tighten across 2023, ending December at a 21-month low of 63 basis points. Lastly, despite expectations for the default rate to increase in 2024, just 13% of December’s trade activity transacted at a bid below 90, with only 7% bid below 80.