March 5, 2024 - Broadly syndicated loan (BSL) returns shrugged off a higher-than-expected inflation reading and increased to 0.91% in February, according to the Morningstar/LSTA Leveraged Loan Index (LLI). Despite the hiccup on the inflation front, the strong economy propelled the S&P 500 5.2% higher in February, while corporate bond performance was mixed in light of uncertainty around interest rates: High-yield bonds returned 0.29% while investment-grade bonds declined 1.5%, according to the Bloomberg Indices. For loans, market value gains contributed to higher loan returns in February, adding 0.17% to total return in contrast to a drag of 0.12% in January. Year-to-date, the return for loans is 1.59%, compared to 0.29% for HY bonds.

While the market pushed out its forecast for interest rate cuts to June, a higher-for-longer rate environment that favors floating rate loans, combined with a strong economy, drove investor appetite for yield. Higher base rates drove the lion’s share of total return, or 0.74% of February’s 0.91% return.

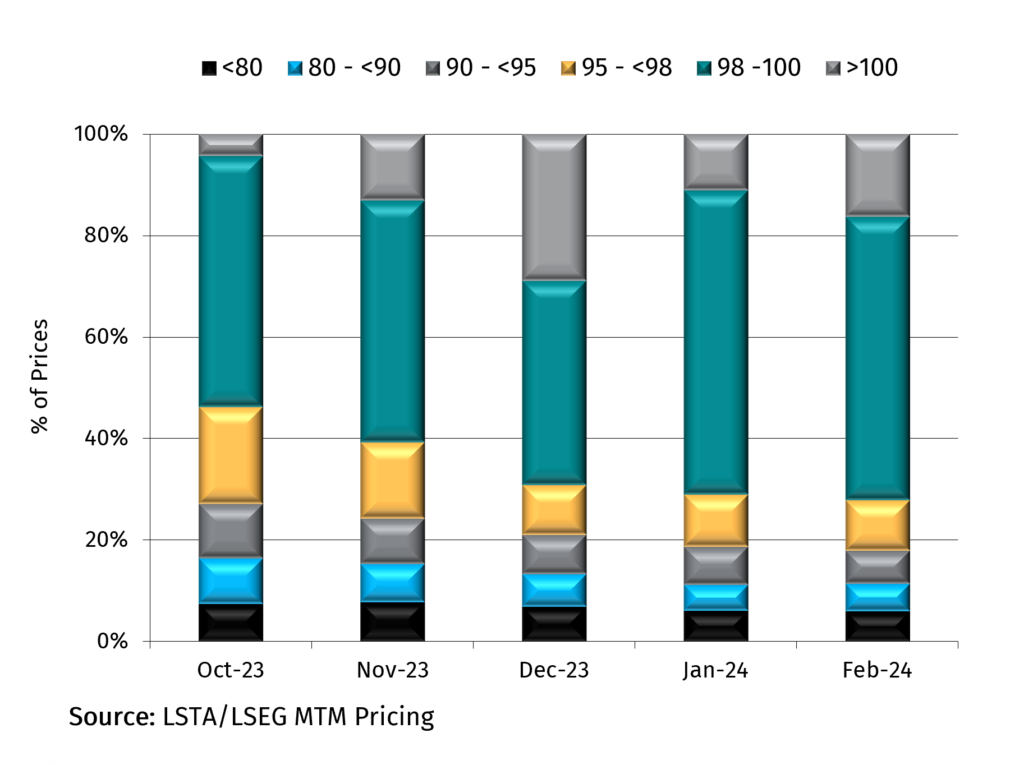

In fact, looking across the last few months, several measures of loan market stress have eased: The share of the secondary priced less than 80 declined for three consecutive months to end February at 6%, down from 8% in November 2023. And the share of the LLI rated CCC, another vulnerable part of the market, is 8% lower so far this year. While the credit picture has been consistent, the trailing 12-month loan default rate (including distressed exchanges) ticked up to 3.67%, per Fitch Ratings.

Back to the secondary market, average prices advanced 18 basis points in February to 96.45 – the highest level since May 2022. Higher prices pushed the par-plus share of the market five percentage points higher to 16%, after reaching a high of 29% in December before a wave of repricings and refinancings. In sum, 60% of loans advanced in February, and the LLI price advanced in 16 out of 22 trading sessions, with the average bid-ask spread tightening to 91 basis points. Investor appetite for yield sent returns on the riskiest credits higher. Loans rated CCC returned 2.35% and outperformed the benchmark index for a third consecutive month in February, compared to 0.89% for B rated loans and 0.67% for BB rated loans.

In the primary market, the strong market tone continued, albeit with less repricing/refinancing candidates available, institutional lending declined 67%, according to Pitchbook LCD. But that masked an uptick in M&A activity that increased the size of the institutional market for the first time in five months and sent LLI outstandings $8.3B higher in February.

Although new loan supply was higher, it remained insufficient to meet high demand, especially from CLOs. A total of 42 CLOs priced in February for $20.2B in volume, propelling CLO new issue to the fastest start to the year since the Global Financial Crisis. Year to date volume stands at $32.7B, 45% higher from a year earlier and 34% ahead of the previous record pace set in 2021. And although market observers don’t expect volumes to eclipse 2021’s record, high investor demand has improved the arbitrage math for CLOs. On the liability side, average spreads for AAA BSL CLOs tightened to 157 basis points over 3-month SOFR in February, compared to 177 basis points at the end of last year. Overall, February was the second busiest month on record for CLO issuance, but it was the busiest for private credit/middle market CLOs. These added $5.43B in the month for a 27% share of activity. Like BSL CLOs, spreads on PC/MM CLOs tightened in February, to 198 basis points from 230 basis points a month earlier.

Lower CLO bond spreads have also led to a resurgence in CLO reset and refinancings. Together, these amounted to $15.3B in volume in February, the highest since 2021. Most of the activity was centered on resets ($10.6B) as managers opted to cut their spreads and extend the life of the structure, preserving assets under management.