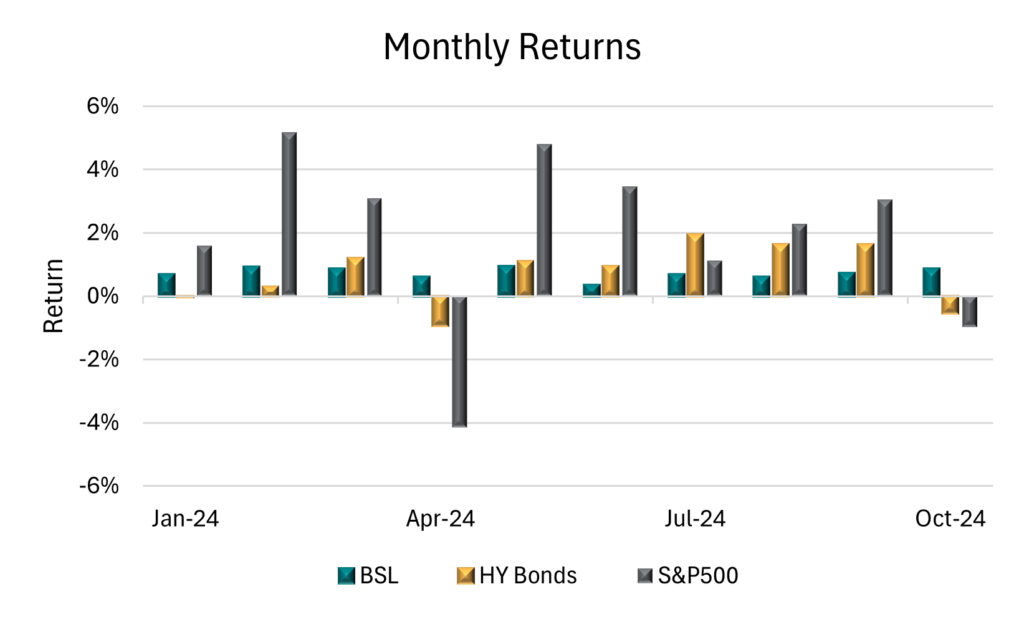

November 12, 2024 - Broadly syndicated loans (BSL) advanced in October, defying broader market uncertainty that dragged down other asset classes. Returns on the benchmark Morningstar LSTA Leveraged Loan Index (LLI) rose to 0.86%, the best performance since May, while U.S. high-yield (HY) bonds declined by 0.54%, per the Bloomberg U.S. High-Yield Corporate Bond Index. The S&P 500 experienced a rare loss in October (-1%), and the benchmark 10-year Treasury bond also sold off, pushing yields 48 basis points higher to 4.28%, reflecting investors’ uncertainty about the Federal Reserve’s path on interest rate cuts. For the year-to-date, BSL returns stand at 7.45%, in line with HY bond return of 7.42%, while the S&P 500 is up 19.6%.

October was the first time in seven months that the secondary market provided a tailwind to BSL returns. The average price on the LLI reached 97.06, the highest level since May 2022, before ending the month 19 basis points higher at 96.9. This market value gain contributed 0.13% to the monthly return, while interest income added 0.73%, lower than the average of 0.76% observed over the rest of 2024, in part reflecting the decrease in SOFR following the Fed’s September interest rate cut. By another metric, advancers outpaced decliners for the first time since July, as 62% of loans ended the month at a higher price, and 32% declining. Like three months ago, a majority of secondary market gains were incremental, with. 55% of loan prices up by less than 1%. And since the sharp bout of volatility on August 5— when the average price on the LLI dropped by 54 basis points and the average bid-ask spread widened by 14 basis points to more than a point —prices have rebounded by 106 basis points, and the bid-ask spread has tightened by 21 basis points.

The pricier secondary market sent the share of loans market above par 8% higher month over month to include one-third of the market, ushering in more repricings. More than half of October’s institutional loan activity was driven by repricings, with non-refinancing activity declining from the previous month but remaining above the levels seen over the last two and a half years, according to PitchBook LCD.

Notably, year-to-date activity in the primary market surpassed the $1 trillion mark – a milestone for the $1.4 trillion institutional loan market. Although most of this activity was driven by record levels of repricings and refinancings and does not represent new money, the growth in non-refinancing activity over the last two months increased outstandings in the LLI to their highest level of the year. In October outstandings were up $16.5 billion to $1.399 trillion, the largest monthly increase in two and a half years, wiping out the modest decline in loan outstandings seen for most of the year.

Underlying these gains was strong demand from both retail and institutional investors. On the retail side, persistent inflows into loan exchange-traded funds (ETFs) led to mutual funds inflows of $2.8 billion in October, reversing two months of outflows, according to LSEG Lipper. In the CLO market, which holds about 70% of outstanding institutional loans, new issue volume surged to its highest level since May (highest on record if you include CLO resets and refinancings). A total of $23.5 billion of new CLOs priced in October, including $17.1 billion of BSL CLOs. Year-to-date, CLO activity has reached $164 billion, approaching the record of $187 billion set three years ago. October’s strong CLO issuance underscored robust demand, tightening the average AAA spread for BSL CLOs to 142 basis points over 3-month SOFR, with several top-tier managers pricing under 135 basis points.

Turning to credit risk, the share of the market priced less than 80 ended October at 6%, where it has been most of the year, while the trailing-twelve-month default rate in the LLI declined to 0.73%, down 1% compared to the cycle high reached in the summer of last year. Although that doesn’t tell the full story. When we factor in distressed exchanges, the default rate is higher at 4.4% (by count), highlighting the impact of liability management transactions (LMTs) on the market.