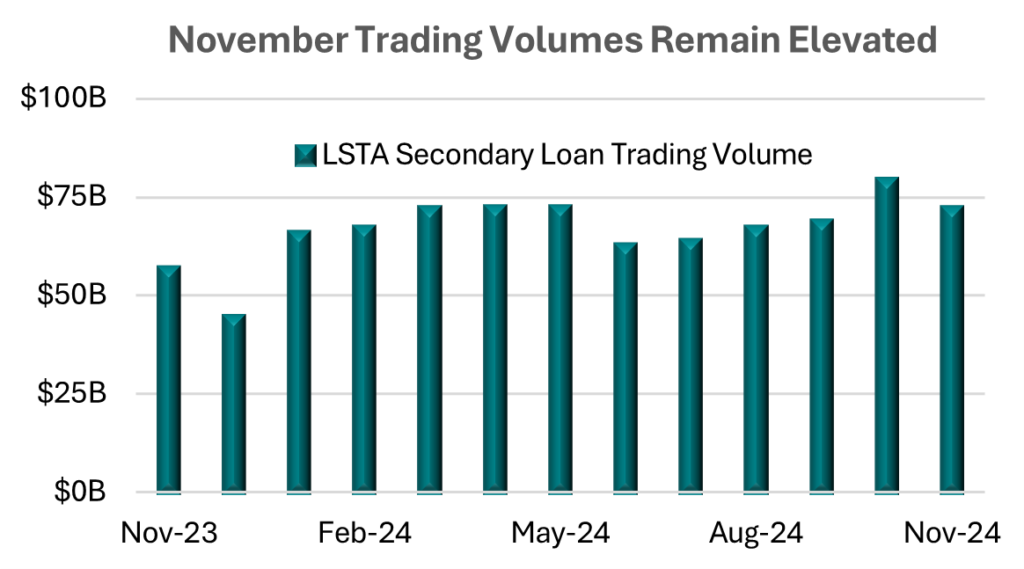

December 19, 2024 - LSTA secondary loan trading volume remained elevated in November at $72.3 billion, noting that monthly activity remained above the $70 billion barrier for the second month running and for the first time since May. While November volume actually slipped 9% month-over-month, October was a hard comp to beat at $79.4 billion, or the third busiest month on record according to LSTA’s historical trade stats. Year-to-date trading volume now stands at $765 billion or 14% ahead of the same time last year. If we were to apply that same 14% increase to last December’s activity, full year 2024 volume would total $816 billion, or $8 billion less than 2022’s record $824 billion. At the very least, 2024 is most definitely going to mark the second busiest year in the secondary at north of $800 billion in activity.

November price action supported October’s bullish trend with advancers once again outpacing decliners, this time at a ratio of better than 4:1 (based on the 1,376 loans that traded across October and November). In turn, the median trade price level increased to a four-month high of 99.9, noting that the median price had hit 100 during June and July – which marked the strongest bid secondary since February of 2021. But that is not to imply that today’s secondary market is not well bid, it’s just a bit more bifurcated. To that point, 49% of volume transacted at a price level north of par value, with 9% of volume changing hands in a sub-90 context. Even more telling, 75% of volume changed hands at a price point of 98 or better. Finally, November’s median bid-ask spread on the traded universe of loans (which totaled 1,577 loans), remained range bound in a 50-basis point context. In comparison, that figure stood at 55 basis points back in February 2021.