July 25, 2019 - Perhaps it’s not actually a full-on bacchanalia in the loan market. To be sure, we are 10 years into a recovery, Fitch’s loan default rate sits at just 1.5% (and is expected to just inch up through 2020) and lenders are likely to accept lower spreads and looser terms. However, even in this environment, recent research from Covenant Review and LCD suggests a market that does demonstrate rational behavior.

First, LCD points to a market that is more balanced than last year, which may give loan investors the spinal fortitude to (occasionally) push back on deals. While year-to-date CLO formation is strong – $65 billion – it’s counterbalanced by LPC/Lipper’s $32 billion of loan mutual fund outflows in the past 35 weeks. With CLOs the main buyer, their needs – dictated both by credit selection and a series of ratings, spread and diversity tests – may well drive terms. If loans meet their criteria, there likely will be considerable appetite (and potential reverse flex). Loans that do not check CLO boxes may struggle.

Recent research from Covenant Review suggests that lenders are treating companies and industries rather differently. First, Covenant Review analyzed what we like to call “The Three LBO Bears”. The three deals – Teneo, Whataburger and Press-Ganey – rated a 4- on Covenant Review’s Initial Documentation Score scale of 1 (most protective) to 5. But after that, the LBO Bears Diverged. Even though Teneo was rated B2/B, Covenant Review noted it was asset light; it flexed up and tightened documents to a 4+. Whataburger garnered a B1/B rating and flexed slightly tighter, but the documents and terms were made more lender friendly; it closed at a 4 flat rating. Meanwhile, Covenant Review reported that Press-Ganey, despite a B3/B rating, is viewed as a seasoned name in the healthcare sector; it flexed down and cleared with borrower friendly terms. It remained at a 4-. Clearly, lenders treated the three deals differently.

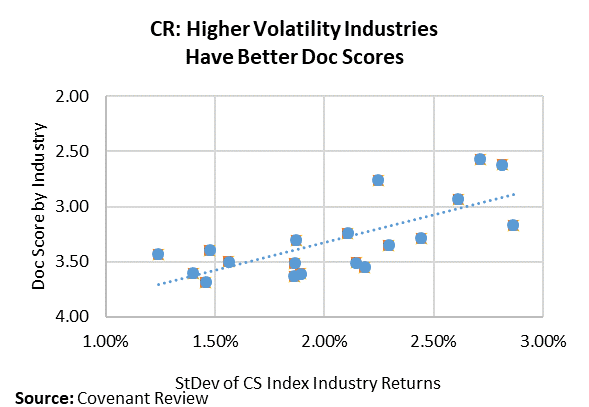

Of course, a sample of three is hardly robust. Fortunately, Covenant Review also published an intriguing industry analysis, looking at the relationship between the volatility of loan returns by sector and their documentation scores. (Confession: Flashy charts do tend to catch our eye, but this one – see COW – is worth a look.) Covenant Review observed that industries with higher return volatility according to the CS Index tend to have lower (safer) documentation scores. Industries with lower return volatility (presumably stabler industries) tend to have higher (less conservative) documentation scores. This makes satisfying intuitive sense. A defensive industry (which should have less volatile returns) should be able to tolerate higher leverage or looser documentation. Conversely, a cyclical industry perhaps cannot tolerate this flexibility. These two analyses suggest that, while we are deep into a long recovery, deal terms still may make ordinal sense.