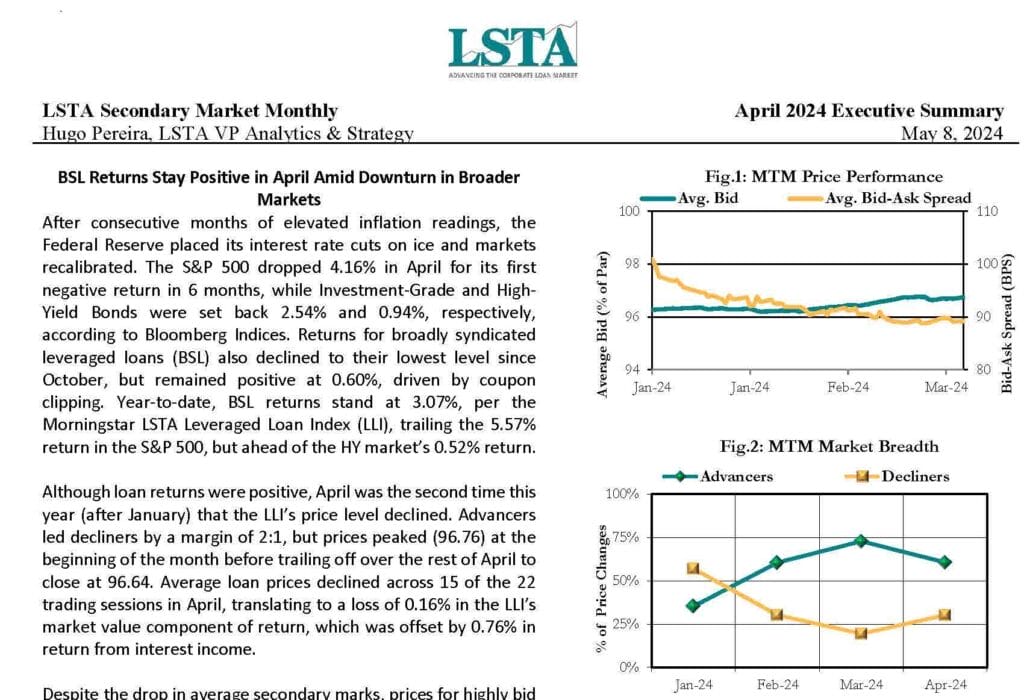

After consecutive months of elevated inflation readings, the Federal Reserve placed its interest rate cuts on ice, and markets recalibrated. The S&P 500 dropped 4.16% in April for its first negative return in 6 months, while Investment-Grade and High-Yield Bonds were set back 2.54% and 0.94%, respectively, according to Bloomberg Indices. Returns for broadly syndicated leveraged loans (BSL) also declined to their lowest level since October, but remained positive at 0.60%, driven by coupon clipping. Year-to-date, BSL returns stand at 3.07%, per the Morningstar LSTA Leveraged Loan Index (LLI), trailing the 5.57% return in the S&P 500 but ahead of the HY market’s 0.52% return.

| File | Secondary-Market-Monthly-April-2024-Executive-Summary.pdf |

|---|