May 7, 2020 - COVID-19 is redefining life; rather less importantly, it also is reshuffling the U.S. LevFin market. When the world began to spiral in March, leveraged borrowers reacted by locking in liquidity through $268 billion of drawdowns, according to S&P/LCD. While locking in liquidity is crucial, terming it out and reopening revolver access is important too. To do so, many borrowers turned to the HY bond market in April.

Why bonds? In a PLI webcast (that the LSTA joined), a panelist noted that there are foundational reasons why bonds may be more attractive today. First, investor demand. Refinitiv and Lipper note that March outflows were huge for both HY bonds ($12.3 billion) and loans ($14.4 billion). But in April, HY saw $12 billion of inflows, while loans suffered another $1.7 billion in outflows. Additionally, CLOs are the main buyer of loans, and that market is mostly stalled. Net-net: little investor demand for loans; strong investor demand for bonds.

Meanwhile some characteristics of loans – MFN, no call protection – may push borrowers toward bonds right now. By mid-April, prices were in the high 80s/low 90s for performing loans and bonds. However, HY bonds generally have substantial call prices, increasing upside for investors. Conversely, limited call protection in loans can reduce the upside to investors (and require a deeper discount to make the economics similar). In addition, MFN language could reprice yields on existing loans to that of new loans, making the entire loan capital structure more expensive. For these reasons, borrowers may prefer high yield bonds today.

These preferences coalesced into volume trends. U.S. HY bond issuance shot past $36 billion in April, up from $4 billion in March, according to LCD. Moreover, nearly half the bond issuance was secured and some of it came with a five-year tenor, making it a pretty clear substitute for institutional term loans. Meanwhile, the leveraged loan market reopened – weakly – to several rescue financings and highly-rated, regular-way deals in April. This permitted institutional loan volume to claw its way up to almost $9 billion, from practically nil in March.

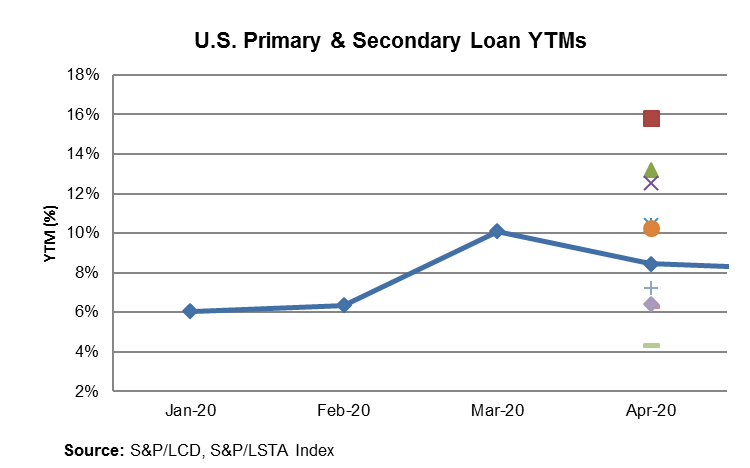

Pricing on new issue loans is, of course, informed by yields available in the secondary. The average Index loan spread-to-maturity nearly doubled between January (LIB+416) and March (LIB+816), before easing in April (LIB+705) as secondary prices recovered. A handful of companies, like Landry’s and Revlon, sought rescue finance and offered commensurate yields above 10% (and above the secondary market average (see COW)). At the other end of the spectrum were companies like Delta and Samsonite offering strong ratings that are attractive to CLOs struggling to maintain WARF. These cleared at much higher rates – LIB+400s and 97 OIDs – than they would have two months earlier, but also much below secondary market yields.

Finally, while yields on the few April loans were higher, documents also were significantly tighter. According to LevFinInsights, documentation scores tightened nearly an entire point – from 3.63 in the three months ending in March to 2.81 in April. All this supports the adage that the best of loans are done in the worst of times. Here’s hoping to better times and worse deals in the days to come.