June 5, 2024 - Markets rallied in May, driven by a better-than-expected inflation reading combined with weaker consumer spending data that puts the economy back on a glide path to a soft landing. Investors responded by increasing their exposure to risk. The S&P 500 soared 4.8% in May, rebounding from the first negative reading of the year in April (-4.16%), while high-yield bonds advanced 1.10%, according to Bloomberg U.S. High-Yield Corporate Bond Index. Prices in the broadly syndicated loans (BSL) secondary market reached the highest level in two years, propelling returns to 0.94%, according to the Morningstar LSTA Leveraged Loan Index (LLI). For the year to date, BSL returns stand at 4.04%, ahead of HY bonds’ 1.63%, as demand for floating-rate loans in a “higher for longer” interest rate environment and stable economic backdrop continues to provide support for the loan asset class. In fact, higher base rates added 0.78% of the 0.94% of total return in May, and 3.92% of 4.04% total return so far this year. At the same time, the trailing twelve-month default rate declined to 4.2% in May from 4.5% the previous month, per Fitch Ratings.

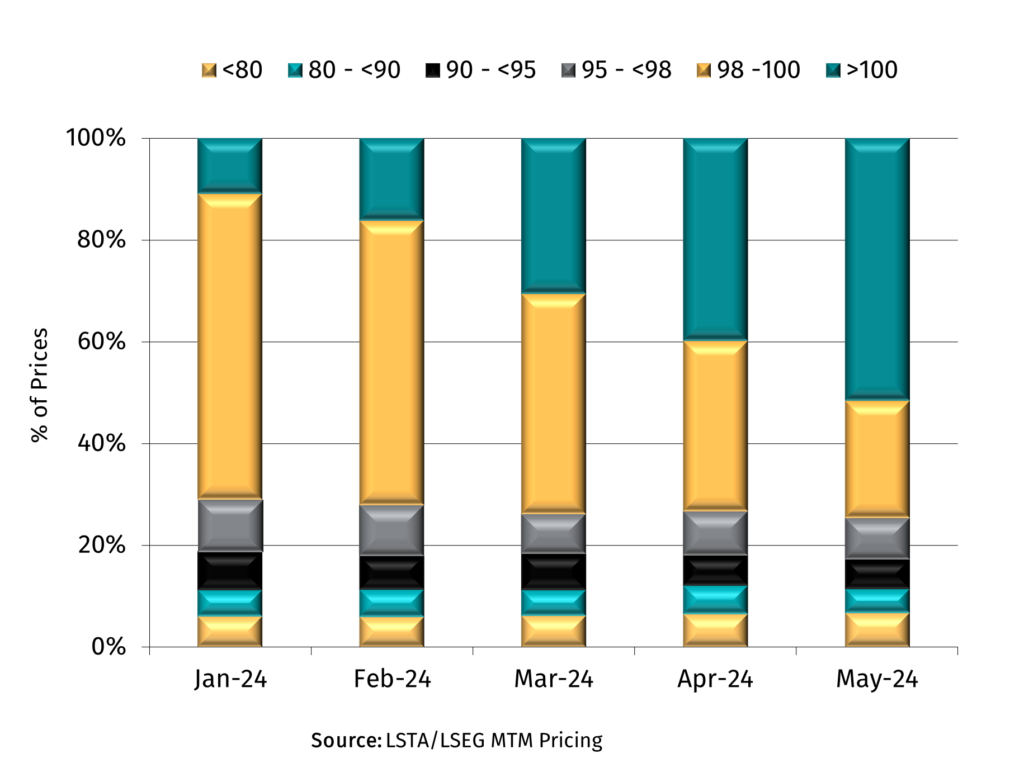

In sum, the average price in the LLI increased 29 basis points in May to 96.93, with 68% of loans advancing and 25% declining. Investor appetite extended down to the riskiest credits, outperforming the benchmark LLI: B rated loans returned 0.99%, 20 basis points ahead of BB loans’ 0.79%, with CCC rated credits jumping 1.26% (7.3% share of the index). Looking at the distribution of prices in the secondary, although the share of loans bid below 80 edged 1% higher in May to 7%, demand for performing credits is strong and propelled the share of loans bid above par to 52%, the highest level since September 2018.

Like the beginning of the year, when a significant share of the secondary market was bid above par, May spurred yet another repricing wave in the primary market, surpassing January levels. According to Pitchbook LCD, a record $180B of institutional loans priced in May, with repricings accounting for two-thirds of that activity, as borrowers rushed to capitalize on market conditions and cut interest costs. According to Citi estimates, issuers reduced the market’s margin by five basis points in May, on top of the eight basis points of compression across January-April. And while M&A activity is slowly increasing it remains well below the levels before the Federal Reserve started hiking interest rates in 1Q22, as buyers and sellers of companies remain wide apart on valuations.

All told, the frenzy in the primary market did not grow the size of the market. Using loan outstandings in the LLI as a proxy, the size of the institutional market shrunk 0.63% in May and remains 3% below its record level reached in October 2022. In contrast, visible demand for floating-rate leveraged loans and CLO bonds is higher leading to widened imbalance between supply and demand of approximately $37B in May and over $100B year-to-date.On the demand side, CLOs led the way in May, adding $23.5B of new issuance, the second busiest month on record, as 44 different managers priced 48 deals. On the retail side, flows into loan mutual funds & ETFs accelerated to $4.3B in May, representing the highest inflow to the asset class in two years, according to LSEG Lipper.