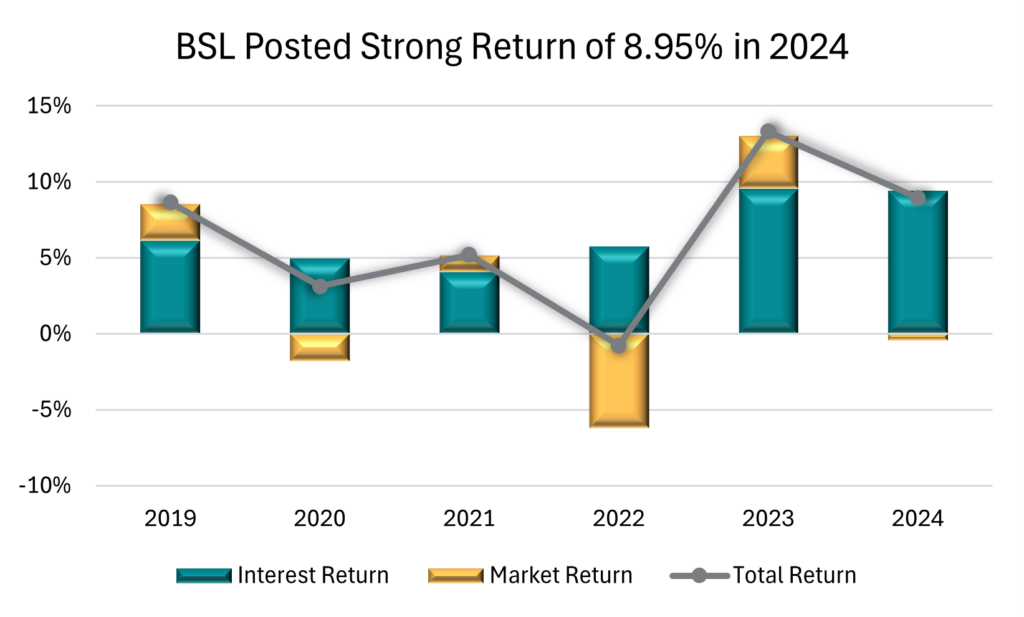

January 9, 2025 - Attractive yields in a benign credit environment drove demand for loans in 2024. Carry propelled returns on U.S. broadly syndicated loans (BSL) to 8.95%, according to the Morningstar LSTA Leveraged Loan Index (LLI). Although performance declined from 2023’s post-Crisis high of 13.3%, it marked the highest return in eight years and well above the asset class’s 10-year average (5.25%). High interest rates supported attractive yields. Three-month SOFR averaged 5%, generating monthly interest returns of 0.75% and annual returns of 9.37% (including spread), which offset a 0.42% market value loss. Interest income declined from 9.54% over the course of 2023, as 100 basis points of Fed rate cuts combined with record repricing activity to reduce borrowers’ interest payments. In December, loan prices advanced to the highest level all year before declining 12 basis points post- Fed meeting when the central bank signaled it would need to see more progress on inflation for additional cuts. The dip in loan prices translated to a market value loss of 0.13% in the index, for a total return of 0.57%, the lowest in six months.

But floating rate loans fared better than fixed rate bonds from the Fed’s more hawkish posture. Although interest-sensitive U.S. high-yield bonds received a boost from the Fed’s interest rate cuts in the second half of the year, December’s negative return of 0.43% meant bonds finished the year behind BSL at 8.19%, per the Bloomberg U.S. Corporate High Yield Index. Both asset classes trailed the technology- driven 25% total return of the S&P 500.

Robust investor demand also fueled unprecedented primary market activity. Overall institutional volume jumped 2.5 times year-over-year to a record $1.36 trillion, according to Pitchbook LCD. However, most of the activity (82% share) was in the form of repricings and refinancings and does not represent new loan supply. Therefore, a huge swath of the $1.4 trillion institutional market turned over, tightening the nominal spread on the LLI 28 basis points to 341 basis points, as some issuers returned to market several times in the year to cut interest costs. Away from record repricing and refinancing, new loan supply from M&A, LBOs and other acquisitions was limited by the same high interest rates that boosted performance and attractive yields.

Consequently, the size of the institutional market remained broadly flat this year from its peak in 4Q22, with outstandings in the LLI up 1.2% in 2024 to $1.141 trillion, equal to an increase of $21 billion, and insufficient to meet demand.

And demand was particularly strong from CLOs, the largest buyers of leveraged loans. Gross new issue was record

$201.6 billion, surpassing 2021’s high watermark by 8%. And the market is expected to remain busy in the new year – investors remain hungry for floating rate investments and CLOs represent the only scalable high-quality floating rate asset. High volume drove average AAA BSL CLO spreads tighter to 131 basis points in December from 161 basis points at the start of the year. This incentivized CLO managers to reduce spreads and extend existing structures, leading to record CLO refinancing and reset activity of $306 billion. Despite the headline volumes, net supply of CLOs, accounting for amortization and liquidations, is closer to $57 billion, according to BofA. Institutional demand for CLOs was broad and deep, but notable was the expansion of retail demand for CLOs in the form of exchange traded funds (ETFs). Assets under management (AUM) for CLO ETFs grew by over $16 billion to $22.5 billion this year, with the largest of these, Janus Henderson AAA CLO ETF growing to $16.6 billion, compared to $9.3 billion of AUM for Invesco Senior Loan ETF, the largest leveraged loan ETF, according to LSEG Lipper data. Retail growth is set to continue with the launch of two private credit CLO (PCLO) ETFs in December, the first of their kind. New issuance of PCLOs reached its highest level in 2024 ($37.3 billion), representing 19% share of overall CLO issuance, a drop from the previous year’s share (23%), but above the historical share of 10%. PCLOs now represent 13% of overall CLO assets under management.

Retail demand for BSL re-emerged this year following consistent outflows since the Fed started raising interest rates in May 2022. Retail loan funds registered $6.3 billion inflows this year, contrasting with $17 billion of outflows in the previous year. This marked the largest inflow to the asset class since 2021, driven by ETF demand of $7.4 billion that outweighed $1 billion of outflows from open-ended mutual funds, per LSEG Lipper.

Turning back to the secondary market, although the average price on the LLI ended the year 110 basis points higher at 97.33, the highest level since April 2022, it was amid high turnover that led the index to register market value losses in seven months out of the year. The LLI’s market value component of return was -0.42% this year, versus 3.46% in 2023, although the supply-demand imbalance led to a run up in prices, pushing the share of the secondary market priced above par higher to include over half of the market several times this year, ending December at 54%. In turn, the average bid-ask spread trended lower over the course of the year to 84 basis points in December.

Across the other end of the price spectrum, the share of the secondary market priced below 80 was contained at 5%. Another indicator of market stress, the share of the market rated B-, was rangebound at 23-24% in 2024, while the share rated CCC declined to include 125 loans or 6% share of the index, from 8.4% a year earlier. Loans rated CCC went on to return a respectable 8.87% in the year, with the high spread on this the riskiest segment of the market making up for declining prices in the fourth quarter (down 3.7 points to 81.26). B rated loans, the largest component representing two- thirds of the LLI, returned 9.55%, ahead of the 8.15% return from loans rated BB (20% of the index).

Regarding defaults, while traditional failure of payment and chapter filings declined in 2024, overall defaults have increased over the course of the year, driven by liability management transactions (LMTs). LMTs pushed the LLI’s default rate (by count) to 4.7% in December, from 4% at the beginning of the year. However, a ruling by a U.S. Court of Appeals on December 31 may impact the prevalence of LMTs going forward.