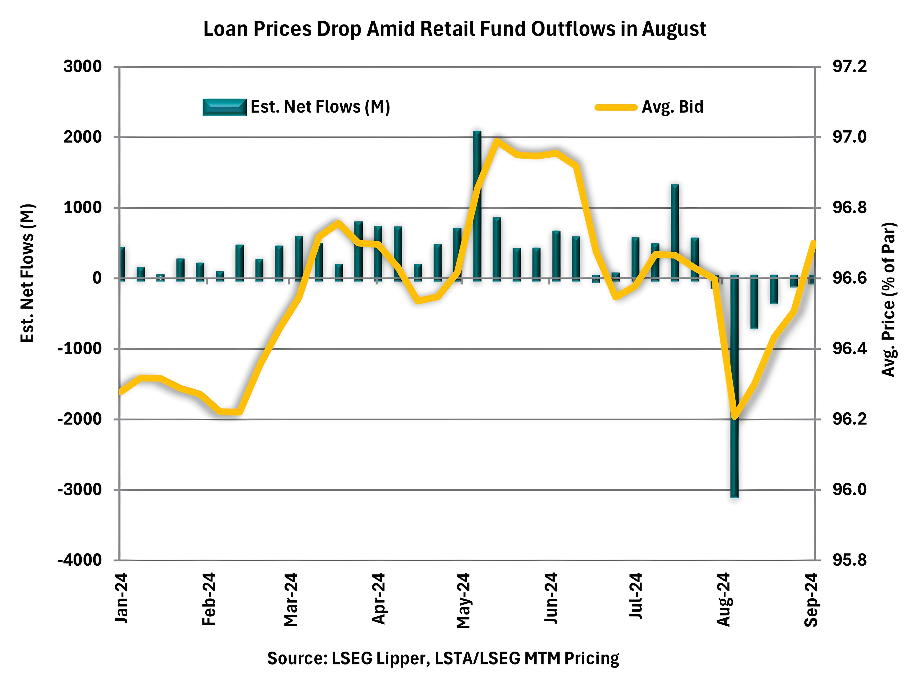

September 10, 2024 - Volatility returned in August, with markets plummeting early in the month on concerns about the health of the U.S. economy, combined with a more hawkish-than-expected statement from Japan’s central banks that prompted the unwinding of the U.S. dollar/yen carry trade. In the loan market, the average price on broadly syndicated loans (BSL) dropped 56 basis points on August 5 to a year-low 95.84. It was the sharpest drop in the BSL market since March 2023, when investors reacted to the failure of Silicon Valley Bank. Markets rebounded the rest of the month, helped by the first sub-3% inflation reading since March 2021, and a strong retail sales report. Nevertheless, the volatility was a reminder of the fragility in markets and led to an inflection point in interest rates when the Fed Chairman confirmed later the central bank’s intention to begin easing monetary policy. Against this backdrop, BSL prices rallied 91 basis points to end August at 96.75.

From a returns perspective, the Morningstar LSTA Leveraged Loan Index (LLI) recovered to return 0.61% in August, slightly below the prior month’s 0.68%. Total returns were again propelled by interest income with the market value component of return negative in August for a third consecutive month and five of the eight months so far this year. In sum, the year-to-date total return of 5.78% has been entirely driven by interest income, with the LLI recording market value losses of 0.53% over the same time.

Despite a flat secondary this year (loan prices have been rangebound between the 96.4 and 96.9 levels for most of the year), the higher for-longer interest rate environment has been a tailwind for floating-rate loan performance. But with the expectation of lower interest rates, investors have begun to pivot towards high-yield (HY) bonds, which outperformed leveraged loans with returns of 1.63% in August and 3.6% over the last two months, according to the Bloomberg U.S. High-Yield Corporate Bond Index. Although HY bond prices followed broader markers lower in early August, they jumped 200 basis points since and have increased 241 basis points over the last two months to 95.5, the highest level since April 2022. Adding it all up, recent performance has closed the gap between BSL and HY bonds with the latter now leading with YTD returns of 6.28%, compared to BSL’s 5.78%.

Delving deeper into the performance of the BSL market in August, the sell-off at the beginning of the month led to a spike as the average bid-ask spread to 102 basis points, before narrowing to end the month at 92 basis points. Performance across the riskiest loans (rated CCC) was negative in August for a second consecutive month (-0.05%), while B rated loans fared better (0.76%) compared to BB rated loans (0.62%).

While returns across the riskiest cohort declined across the last two months, they nonetheless lead year-to-date, with CCC loans returning 6.40% and B loans returning 6.13%. Another feature of this year has been the large share of loans in the LLI priced above par. It reached a peak of 52% in May and declined to a year-low 10% in early August before rebounding to end the month at 38%. This richly priced share of loans reflects high investor demand for BSL this year and served as a beacon for borrowers to reprice their loans, something they have done at record levels this year. But the volatility in August (combined with the traditional August summer lull) forestalled the repricing engine with lending activity dropping to the lowest level all year.

One place where there was no summer break was the CLO market. Over $15B of new CLOs, across 32 deals, were issued in August. New-issue activity was $2.3B higher compared to the prior month, while a year-high $26.2B of CLO paper was reset, adding up to the second highest monthly volume for gross CLO issuance ever. The strong demand for CLOs continues to send spreads lower, with the average AAA spread for BSL CLOs declining to 141 basis points in August. Indeed, spreads have tightened every month this year. Year-to-date CLO volume stands $129.5B, up 77% from the previous year and on record pace for the busiest year.

On the retail side, the volatility at the beginning of the month resulted in an outflow of $3B from loan mutual funds and ETFs for the week ending August 7 – the largest reported weekly outflow since January 2018, per LSEG Lipper. Across the month, retail demand has pivoted away from loans with August recording an outflow of $5B. Conversely, HY bond funds have raked in $5.7B of inflows since July, including $883 million in August.