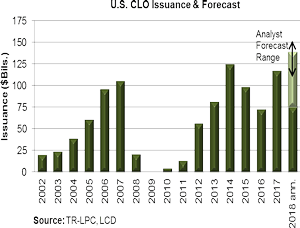

July 19, 2018 - Is there no rest for the weary? As of Thursday, S&P/LCD had tracked $76.5 billion of new U.S. CLO issuance from 138 individual issues. This is up from 102 issues and $57 billion the same time a year ago. As the LSTA Chart of the Week indicates, if the current pace keeps up, this would bring us to record issuance of more than $140 billion for the full year.

But will we keep up the pace? CLO analysts don’t necessarily think so. We scoured recent analyst reports for their full-year forecasts. They ranged from $110 billion on the low end (Morgan Stanley and Citi) to a clustering in the $130 billion context (Nomura, Deutsche and JPM). Wells, who notes that typically 40% of CLO issuance comes between September and year-end, thought we might see upwards of $150 billion.

What could slow us down? It should no longer be lack of collateral. According to the S&P/LSTA Leveraged Loan Index, net loan supply (measured by change in outstandings) totaled $90 billion through the end of June. This strongly outpaced net CLO supply (measured by change in CLO outstandings), which totaled roughly $50 billion, according to TR-LPC’s Leveraged Loan Monthly. But in addition to strong new CLO issuance, 2018 has seen monster reset activity that competes with new issue. According to LCD, year-to-date reset volume has been in the $74 billion context, adding to supply that investors are wading through.

And so, CLO liability spreads have been widening. Deutsche sees today’s average new CLO AAA spread in the LIB+111 context, up nine bps in the past three months. LCD adds that spreads have widened throughout the capital stack, bringing the weighted average financing costs to roughly LIB+169, up from LIB+163 in the last quarter. This has forced CLO managers to push back on particularly tightly priced loans in the primary market. So where are CLO spreads likely to go? There is not exactly consensus. Wells wrote that spreads likely will remain elevated on strong supply. On the other hand, JPM sees LIBOR increasing 60 bps, which could allow AAA spreads to tighten back to the LIB+90 context. Agree to disagree, it seems.