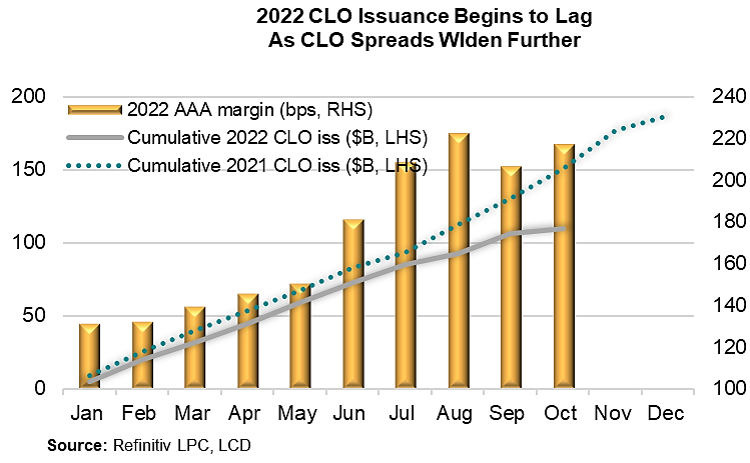

October 20, 2022 - Earlier this year, we wondered how CLO issuance could be at near-record levels even as new issue CLO AAA spreads hit record highs. As the COW illustrates, that contradiction is fading. While CLO AAA spreads (bars) remain incredibly wide – and may go wider – 2022 CLO issuance is now diverging from 2021 record levels (lines).

But the next conundrum is: Why are CLO AAA spreads around record levels when AAA tranche defaults are nearly impossible – and even downgrades are quite unlikely. The answers include a generalized risk-off sentiment, as well as technical pressures.

Clearly there is noise around credit today. Fitch’s TTM leveraged loan default rate climbed to 1.6% in September, the agency saw the volume of “Market Concern” loans top $200 billion and raised its 2023 default forecast to 2-3% for 2023 and 3-4% for 2024. JP Morgan estimated that CCC downgrades could reach 9-11% in a recessionary scenario; combine that with increased default rates and equity cash flows could be diverted in a number of CLOs, Refinitiv LPC reported. Of course, it would be equity cash flows that are diverted, which protects AAA notes.

While there doesn’t seem to be a good argument for avoiding CLO AAAs based on credit risk, the technical pressure cannot be denied. After this year’s stress tests, key US banks largely pulled back from new investments in the asset class. Then, as other asset classes gapped, some relative value players found those markets more attractive, CLO experts say. And now there is noise from the London to Tokyo. As UK pension funds raised funds to meet collateral calls, CLO AAAs were some of the assets they sold. Following several weeks of $1 billion-plus BWICs, generic CLO secondary spreads widened to LIB+205 bps, their widest point on the year, JPM calculated. Next, Norinchukin, the major Japanese AAA anchor, retreated. According to LevFin Insights, Norichukin may have pulled back from anchor AAA positions on four US CLOs slated to hit market later this year. All of this creates noise around the asset class.

But everyone acknowledges that it’s probably too much noise. Analysts testing the structures do not see the same risk that headlines do. Yes, there has been about $92 billion (or 11%) of CLO collateral downgraded this year, BofA reported. And yes, CLOs’ share of B- loans has risen to 29%. However, the share of CCC assets has dropped from 10% in 2020 to 5% today and just 1% of CLOs are failing their CCC concentration limits. The share of defaulted loans in CLOs sits at 0.33% in CLOs, BofA adds. But even if default rates rise, CLOs will still perform, LCD reported. Looking at its rated portfolio, Fitch pushed loan default rates up to 5 and 11%. Even in those cases, modeled downgrades of non-investment grade tranches in reinvesting deals were a mere 0.12% and 1.69%, respectively. Even the FT notes that “the angst [around CLOs] is misplaced.”

And, to be fair, investors probably know all this. According to a just-released Morgan Stanley investor survey, the plurality of voters (36%) said that CLOs offered the best relative value across AAA structured products. So, we all know that SOFR+220+ spreads are not justified by the fundamentals and there’s significant opportunity in AAA notes; it’s just a matter of how long course correction takes.