March 30, 2023 - On Monday, the LSTA submitted the first of three letters responding to the SEC’s Proposed Rule on “Conflicts of Interest in Securitizations” (“Proposed Rule”). This Dodd-Frank mandated Rule was first proposed in 2011, received substantial pushback and lay dormant for more than a decade. The SEC reproposed it in January, with more prescriptive language – and an untenably short comment period. We discuss the Proposed Rule in detail below but the bottom line is i) it is meant for “structured to fail” securitizations, which – as far as anyone knows – do not exist today and definitely do not exist in CLOs, ii) it is unwieldy and unworkable for regular-way securitizations, but worse for CLOs whose underlying assets (leveraged loans) trade actively, iii) in combination with a flurry of other rules, it would likely have a severe effect for CLOs and the companies that rely on them. Read on, brave souls.

Background: In the wake of the financial crisis and several high profile “structured to fail” ABS transactions, in 2011, the SEC first proposed the Conflicts rule. It was widely pilloried and subsequently lay dormant for more than a decade. In the new rule, the SEC acknowledged that they cannot find evidence of “structured to fail” ABS transactions, that “securitization participants may [already] be incentivized to avoid conflicts of interest” and that this might be due to “market participants’ obligation to comply with the existing rules and to reputational incentives”. Despite a lack of troubling transactions and corrective measures already in place, the SEC is going forward with this rulemaking.

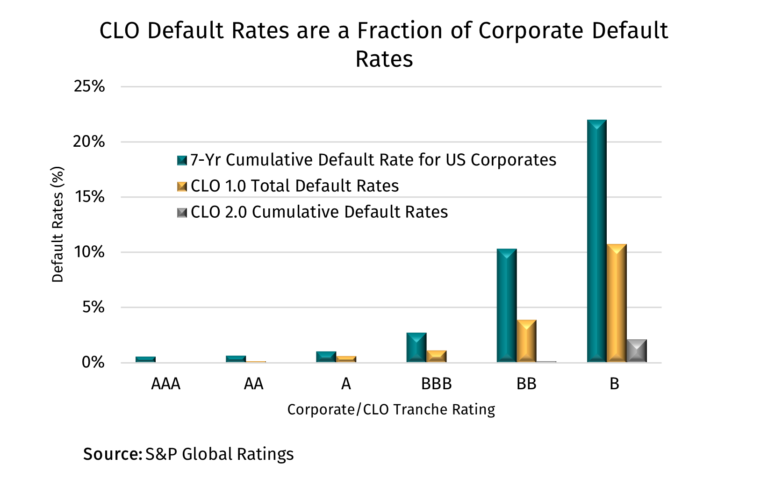

CLOs are not “structured to fail” securitizations: While there has been no evidence of “structured to fail” ABS in the past decade, there has never been evidence that this exists in CLOs. As we demonstrate in the letter (and nearby chart), CLOs have always had much lower default rates than nearly any other asset class. While there probably isn’t a problem in ABS generally, there definitely isn’t a problem in CLOs. Which makes the following rule all the worse…

The prohibitions: The Proposed Rule prohibits “Conflicted Transactions” by securitization participants (for our purposes, largely CLO managers and arrangers), which include (i) a short sale of the ABS security and (ii) the purchase of a CDS or credit derivative whereby the securitization participant would receive payments if the ABS note defaulted or had another credit event. These two prohibitions do not appear too bad on their face. However, the SEC goes further and offers up the now-notorious “Prong (iii)”, which prohibits the entry into a transaction whereby the securitization participant would benefit from (a) adverse performance of the asset pool, (b) loss of principal, monetary default or early amortization event on the ABS, or (c) decline in market value of the ABS. This is problematic for many reasons, but to name a few: 1) no malicious intent is required – a securitization participant might be in a transaction that innocently or randomly does well when the ABS does not; 2) the term asset pool is vague (Is it all assets in the pool? A material amount of assets? One asset?); and 3) some of the activities covered might be contractual rights under an ABS transaction (such as actions that might trigger earlier amortization).

The affiliates and subsidiaries! The Proposed Rule gets worse because it explicitly covers all affiliates and subsidiaries and defines them very broadly, including common control which can be as broad as ownership of voting securities. It also includes foreign subsidiaries and affiliates. Thus, for instance, it’s not simply a specific CLO manager that would be caught up in the rule but if there is an unrelated long-short business somewhere within the asset manager’s organization, that would be captured too.

Information barriers and disclosure (or lack thereof): Worse still, the Proposed Rule explicitly disallows information barriers (that are commonly relied upon in industry) and disclosure and informed consent as a means to manage conflicts. (To be fair to the SEC, they do identify potential ways that information barriers might become acceptable; alas, they are – as written – utterly unworkable.) Between the capture of affiliates and the disallowance of information barriers and disclosure, this means that affiliates largely could not be walled off from the CLO manager and arranger and be permitted to run their businesses. This, along with a very broad definition of Conflicted Transaction, is highly problematic.

Drilling down to CLOs: Everything discussed above is a problem for ABS generally. It gets more complicated for CLOs because the underlying assets – leveraged loans – trade actively and are at the center of many banking activities. In particular, Prong (iii) A, the prohibition of any activity that benefits – however unintentionally – from the adverse performance of the asset pool, creates substantial problems. First, CLO arranging banks often provide warehousing services for CLOs; they may hedge this risk through CDX HY or BKLN – and this might fall afoul Prong (iii) A. A CLO manager might have an affiliate – about which the CLO manager knows nothing – that might take a short position in CDX HY; it’s not clear whether CDX HY might be sufficiently correlated with a CLO asset pool to create a prohibition, but the language is broad enough to worry market participants. Even things as innocuous as LIBOR transition amendments, covenant violation waivers or restructuring agreements might possibly be in scope if these activities were perceived to benefit the securitization participant and result in adverse performance of the related asset pool or ABS or a decline in the market value of the ABS. (For gluttons for punishment, we offer a longer potential parade of horribles on p. 4 of our letter.)

Next steps: The LSTA highlighted these key issues, detailed CLOs’ historical performance and offered a preliminary response to the SEC’s cost-benefit analysis. (Hint: With no benefits – because there aren’t “structured to fail” CLOs – the costs vastly outweigh the benefits.) The second LSTA letter will focus on broader securitization issues. The final letter will drill much more deeply into CLO issues, will detail CLO specific issues and will offer alternative – and workable – solutions.