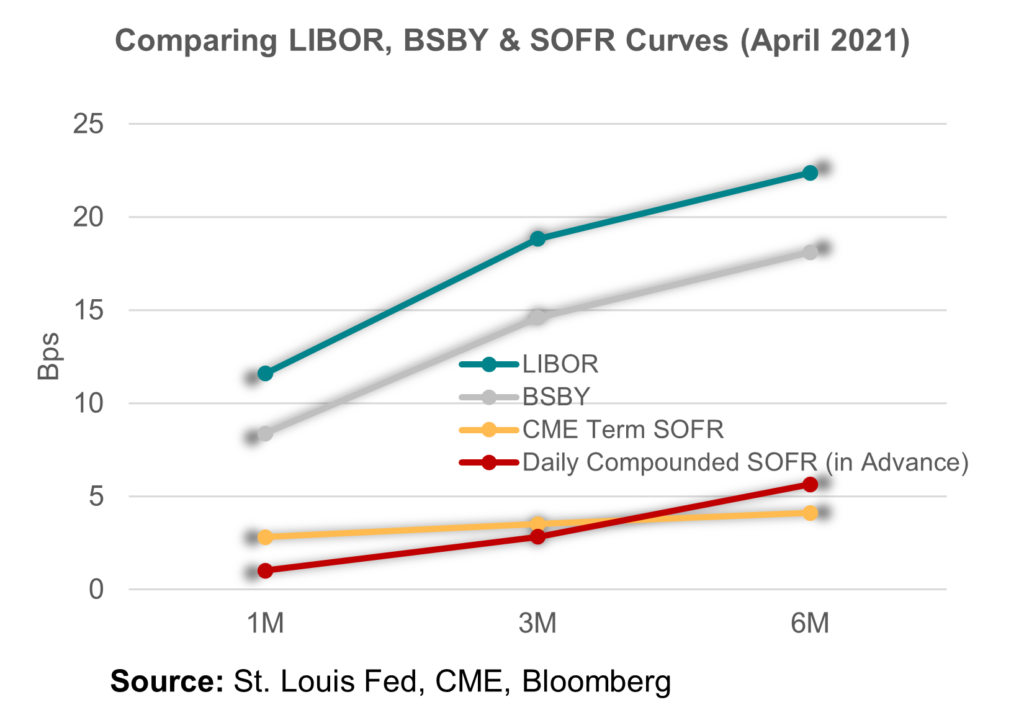

May 13, 2021 - by Meredith Coffey. What’s the economic difference between LIBOR, CSRs and SOFRs? LIBOR and CSRs – like BSBY, BYI, Ameribor and Markit – include a credit risk component, whereas SOFRs are nearly risk free. As a result, LIBOR and CSR curves will be higher and steeper than SOFR curves. Meanwhile, all SOFR curves will be fairly similar. Forward Looking Term SOFR, like the CME Term SOFR on the chart, is the expectation of where Daily Compounded SOFR should be in one or three months. Daily Simple SOFR is nearly identical to Daily Compounded SOFR, because Daily SOFR is a tiny number and compounding a tiny number does not increase it much. Meanwhile, SOFR Compounded in Advance and SOFR Compounded in Arrears are the same rates, just with a temporal shift. In Advance is the rate for the previous period, while In Arrears is the rate for the current period. Finally, SOFR Compounded in Arrears is not on the chart because it doesn’t exist until the end of an interest period – and therefore it’s nearly unchartable.