July 8, 2024 - The robust demand for broadly syndicated loans (BSL) moderated in June, sending the average price on the Morningstar LSTA Leveraged Loan Index (LLI) 34 basis points lower and drawing the asset class to a return of 0.35%, the lowest since October of last year, and below the average monthly return of 0.72% so far this year. Despite the slight decline YTD (13 basis points) in the LLI’s nominal spread from repricing activity, BSL returns continue to benefit from higher SOFR, with the interest income component of return contributing 0.75% in June, compensating for market value losses of 0.4% – it marked the third time this year returns from higher base rates made up for market value losses. Across to U.S. high-yield bonds, returns were 0.94% in June, per the Bloomberg U.S. High-Yield Corporate Bond Index, while the S&P 500 ended the month 3.47% higher. For the first half of the year, BSL returns of 4.4% led high-yield bonds’ 2.58% but trail the AI rally in the S&P 500 that fueled a total return for the index of 14.48%. On a quarterly basis, 2Q24 BSL returns were 1.9% marking the third consecutive quarter of declines and the lowest returns since 3Q22. Performance this quarter lags the 3.15% recorded a year earlier, when the market was rebounding from the sharp losses of 2022.

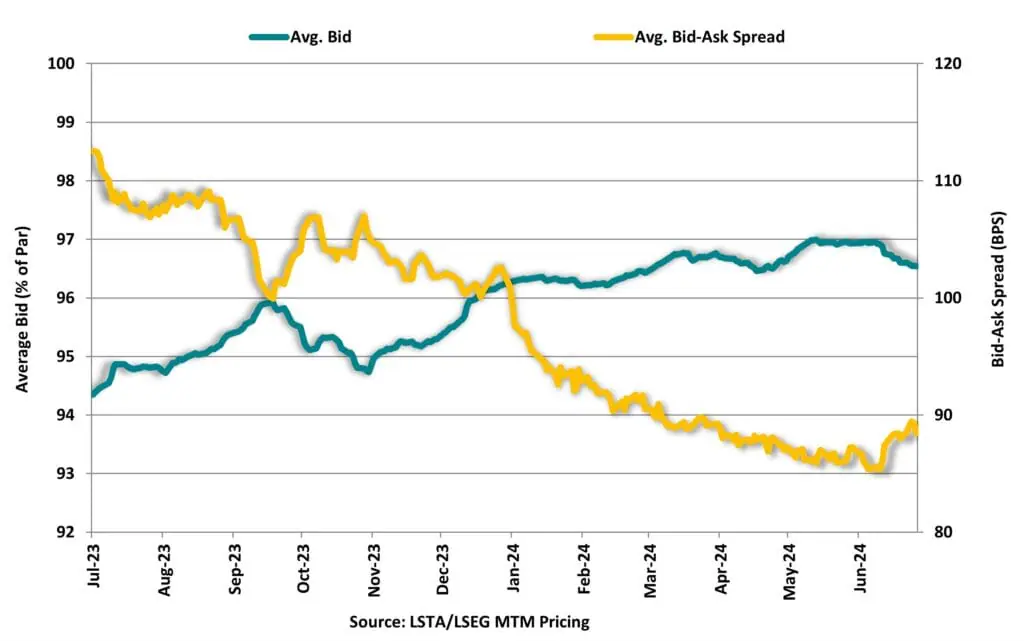

Back to the secondary, loans have been trading sideways since mid-May, when inflation readings reverted to market consensus. Across June, loans declined 34 basis points after the Fed’s interest rate decision on June 12, as investor demand ebbed in line with interest rate projections for the rest of the year. In sum, loans declined in 15 of 20 trading sessions in June translating to 72% of loans declining in value, compared to 20% advancing. It was the first time since January decliners led advancers, with most loans (64%) experiencing modest markdowns of less than 1%. Nevertheless, it was enough to send the share of the LLI priced above par lower from a six year high 52% in May to 37% by the end of June. The pull back in prices widened the average bid-ask spread to 88 basis points – the first time this metric has widened in 2024 after tightening from 100 basis points at the start the year.

Driving performance has been a slowdown in demand for BSL from key constituencies. Issuance of new CLOs, the biggest buyers of BSL, declined 50% month-over-month to $11.7B in June, the lowest issuance total this year, after averaging $16.8B in the prior months to propel CLOs to the busiest first half on record. Although less paper was printed, AAA liability spreads tightened to an average of 145 basis points in June, with several top-tier managers printing as low as 138 basis points.

Away from the institutional demand from CLOs, retail demand from open-ended loan mutual funds and ETFs also declined in June with $1.2B of inflow recorded, the lowest inflow since the beginning of the year, per LSEG Lipper.

Visible demand, as measured by adding CLO new issue to loan fund inflows, dropped to $12.9B in June, the lowest all year. Nevertheless, technicals remain in favor of borrowers when we factor in supply levels. According to the LLI, loan par outstandings increased just $1.95B in June, insufficient to meet demand. The size of the institutional market has been flat over the course of the year, leading to a gap between demand and supply of over $10B in June, and over $117B in 1H24. The reason for the low supply has been lackluster new money activity. According to Pitchbook LCD, although M&A activity has increased YoY, it remains below long-term levels. The high investor demand for loans resulted in wave after wave of repricing amendments and refinancings this year – driving these transactions to record levels in the first half – while non-refinancing institutional activity made up a meager 15% share of volume.