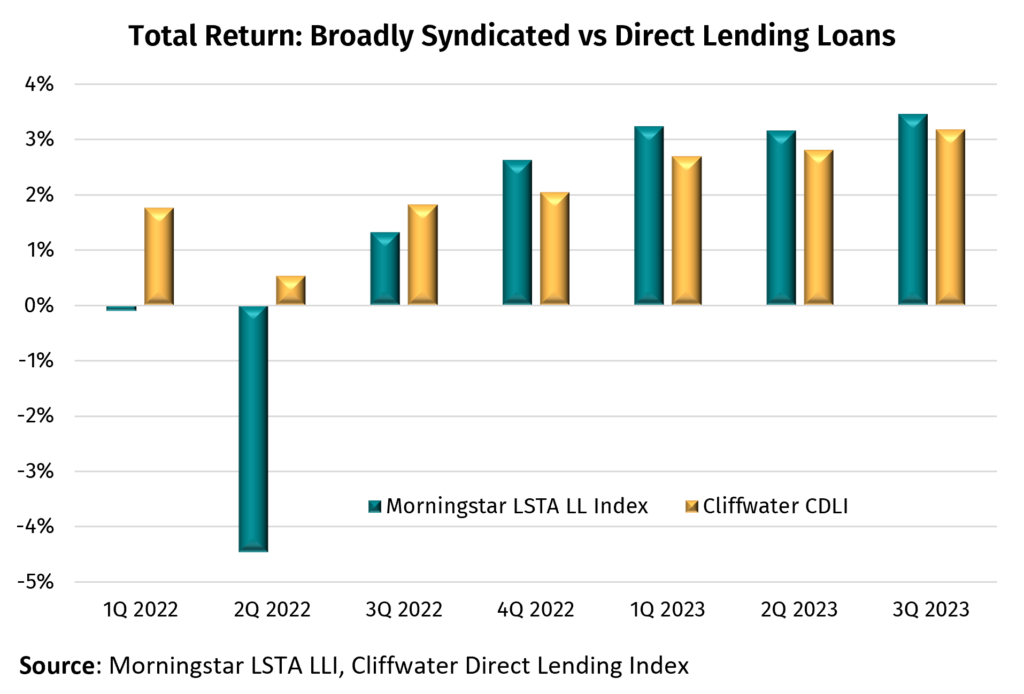

December 14, 2023 - Returns on direct lending loans, as measured by the Cliffwater Direct Lending Index (CDLI) have diverged from their long-term trend and lagged the Morningstar LSTA Leveraged Loan Index (LLI) this year. This dynamic has played out as broadly syndicated institutional loans rallied from the sharp drop in the secondary market last year, when their total return was negative (-0.77%) for only the second time post-Global Financial Crisis. Annual returns on the CDLI have been negative only once (2008) and were 6.29% in 2022.

For reference, CDLI is an asset-weighted index that aims to measure the performance of direct lending loans (the largest strategy within private credit) by using the 14,000 U.S. middle market loans totaling $295B (per the latest update) held by Business Development Companies (BDCs) as a proxy. The index effectively represents the size of the BDC market. Private credit manager Cliffwater launched the index in 2015 with information back-tested to 2004.

Total return of the index increased to 3.17% in the third quarter, the highest since 1Q21. Over the last 12 months, total return is 11.15% with interest income at 11.63%. (By comparison, total return on the LLI was 3.46% and 13% in the third quarter and over the last 12 months, respectively.) Like their BSL counterparts, private loans are floating rate and have benefitted from higher base rates over the last 18 months sending income return higher to 2.94% in the quarter.

CDLI’s total return was offset by 0.24% of realized losses in 3Q23, 0.91% over the trailing year, and in line with the index’s long-term average of 1%. On the other hand, changes to existing loans’ fair value drove unrealized gains higher to 0.46% in 3Q23, as stronger than expected economic growth surprised and drove the average fair value on the CDLI half a point higher this year to 98.42 in September 2023. In this respect, some of the unrealized gains recorded this year are reversals from the -2.64% of unrealized losses or markdowns recorded last year for forecasts that turned out to be overly pessimistic.

That is not to say that portfolios are not under some stress this year from higher interest rates. Realized losses, or principal write-downs generally due to borrower defaults, have increased after being subdued for most of 2021 and 2022. From another angle, the share of the CDLI in non-accrual status (i.e., no longer considered performing) rose to 1.54% in 1Q23 before declining to 1.43% in September 2023.

According to the KBRA DLD Index, the year-to-date default rate (by count) for direct lending loans stands at 2%, translating to 48 defaulters and $6.3B of loan principal. Delving deeper into the defaults by sponsored backed direct loans, consumer sector assets make up 26% of defaults resulting in the highest YTD default rate at 5.9%. Software loans, which constitute 24% of the sponsored universe, registered five defaults this year (1.6% default rate).

KBRA DLD forecasts the sponsored default rate to climb to 2.75% by year-end 2024 with the healthcare and consumer sectors expected to produce the most defaults. Looking across to BSL, leveraged loans default rates are slightly higher with the trailing-12-month leveraged loan default rate (by volume) at 3%, per Fitch Ratings. The rating agency expects defaults to rise to the 3.5%-4% range in 2024 before declining in 2025, factoring the impact of higher-for-longer interest rates and slower economic growth on borrower balance sheets.