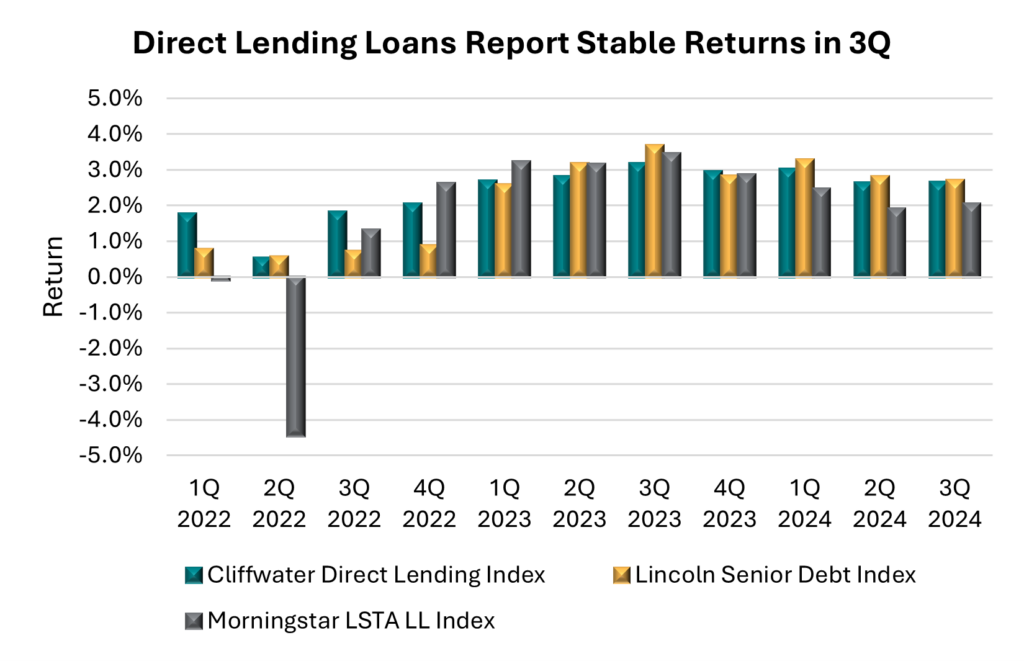

December 11, 2024 - U.S. direct lending loans posted consistent and stable returns in the third quarter, according to benchmark indices that track the asset class. The Cliffwater Direct Lending Index (CDLI) returned 2.65%, while the Lincoln U.S. Senior Debt Index (LSDI) returned 2.7% in 3Q, slightly lower than the LSDI’s 2.8% return in the previous quarter. Both indices provide valuable insights into the performance of the direct lending market, with the CDLI tracking 17,000 directly originated investments held by Business Development Companies (BDCs) totaling $393 billion, while the LSDI is sourced from Lincoln International’s portfolio of 1,600 loans it values for over 175 asset manager clients.

Third-quarter returns reflected the characteristics of direct lending loans, remaining consistent and ahead of the 2% return posted by broadly syndicated loans (BSL), as measured by the Morningstar LSTA Leveraged Loan Index. Direct lending loan returns have outpaced BSL in every quarter this year, reflecting the illiquidity premium on direct loans. Over the last decade, BSL returns have been negative in eight quarters, while direct lending loans have posted a loss in only one quarter (1Q20).

This quarter’s performance continues to be driven by interest income, as SOFR remained at historically high levels, despite the Federal Reserve cutting rates by half a point in September. Looking closer at the components of total return, interest income made up 2% of the LSDI’s 2.7% total return. Loan valuations remained broadly stable across the third quarter, with the CDLI’s average fair value increasing to 99.8, the highest level since 1Q22. High valuations are supported by strong demand for assets, as evidenced by the rapid expansion of direct lending strategies within private credit and tighter asset spreads over the last 18 months. Tighter spreads and declining interest rates contributed to a lower average yield in the LSDI, which dropped 1% to 10.4%, while the CDLI’s yield also decreased to 11.5%.

While higher rates have boosted returns, they also continue to pose challenges for borrowers facing higher interest payments. That said, several metrics can be observed to assess credit quality, which remained stable across the third quarter. For instance, CDLI’s non-accrual share, which represents loans that have stopped making interest payments, declined to 1.3%. The CDLI’s Payment-In-Kind (PIK) income as a share of total income also ticked down to 7% in the third quarter. While PIK loans can signal credit stress for borrowers, they are also utilized by borrowers as a part of their growth plans.

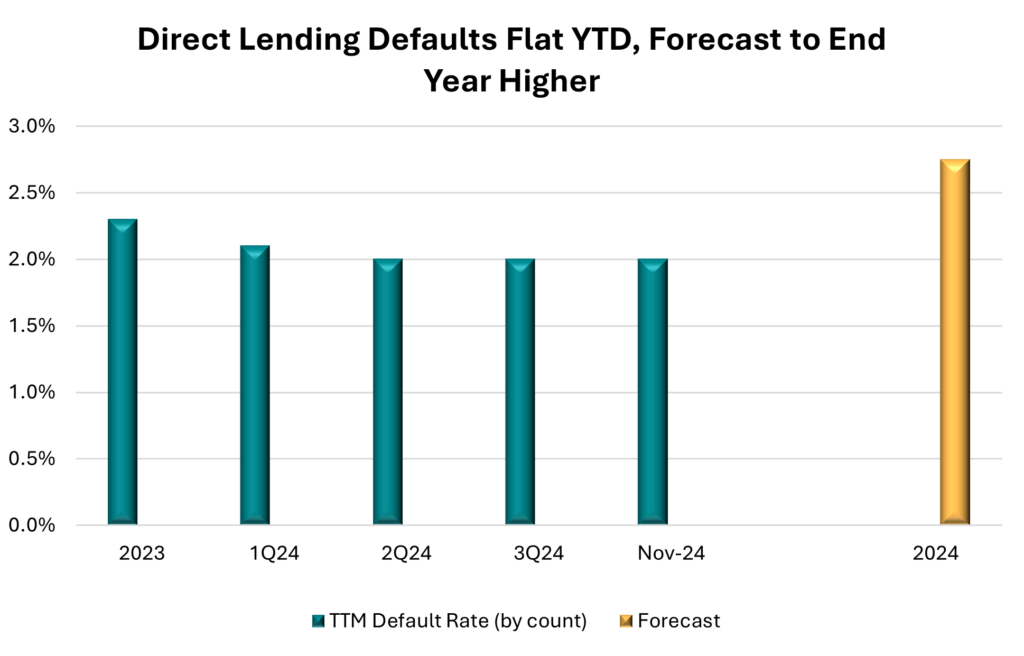

Defaults have declined so far this year. Defaults in the LSDI decreased to 2.2% in the third quarter, from 2.6% in the previous quarter and 3.9% a year ago. The LSDI defines defaults as covenant breaches and does not track conventional defaults. According to Lincoln, this decline in defaults demonstrated the strong relationship between borrowers and lenders in the direct lending market and their ability to proactively address liquidity.

For a broader perspective, the KBRA DLD Direct Lending Index tracks defaults spanning bankruptcies, missed payments, distressed debt exchanges, and restructurings across more than 2,400 issuers. The trailing 12-month (TTM) default rate on this index stands at 2% in November, compared to 2.3% over full-year 2023. KBRA forecasts defaults to rise to 2.75% by the end of the year, reflecting an increase in non-accruals. Sponsored deals are expected to perform better (2.5% forecast) than the non-sponsored universe (4.5%), with the consumer, food and beverage, and healthcare sectors driving default activity. KBRA has characterized its projections as mild and describes the default environment as benign. Meanwhile, in BSL, the October TTM default rate stands higher at 4.7% by volume, according to Fitch Ratings, with much of that activity being driven by out-of-court restructurings.