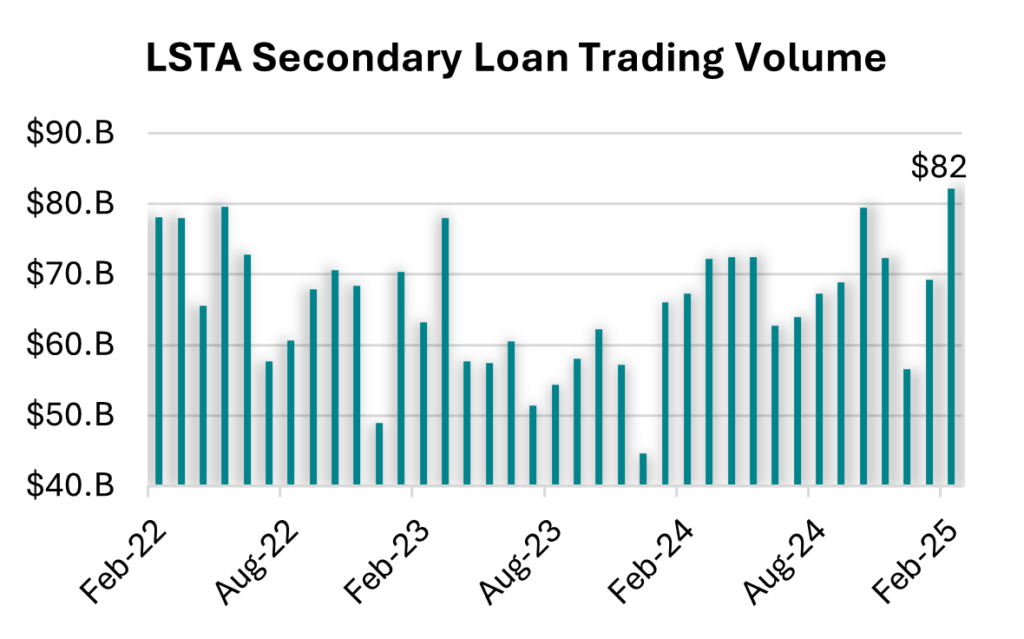

March 20, 2025 - LSTA secondary loan trading volume totaled a staggering $82.2 billion in February, up 19% month-over-month and 20% over the LTM average of $68.5 billion. February marked the second busiest month ever in the secondary, following the record setting $119.3 billion of March 2020 (the onset of COVID). Furthermore, February activity came in 3% higher than October 2024 and May 2022 – the only other two months were volumes ran north of $79 billion. So, what drove February trading volumes higher? First, volatility levels spiked across asset classes, including the loan market. Second, several new, highly liquid multi-billion-dollar loans broke for trading in February, including X Corp’s (Twitter) two term loans, which garnered a tremendous amount of attention across trading desks. According to LCDNews, roughly $38 billion of new institutional loans closed and allocated in February (excluding repricings and other amendments). That said, the two largest loans that broke for trading were the $4.7 billion 9.50% fixed-rate first-lien term loan for X Corp. (which was used to repay the original bridge financing) and the long-awaited placement of the $5.5 billion covenant-lite first-lien term loan which had previously remained on the books of the banks that had originally committed to financing the Twitter buyout back in 2022.

Turning to the topic of volatility, let’s begin with the most liquid side of the market, or the 100 largest loans that reside in the Morningstar|LSTA Leveraged Loan 100 Index (LLI100). Here, trade prices declined by an average of 38 basis points, to 98.04, the deepest selloff in 10 months. But let’s put the “selloff” in better perspective, given that the LLI100’s median trade price declined 10 basis points to 99.96 (after running north of par since December). Across the broader market, bids weakened during 17 of 20 February trading sessions, where decliners outpaced advancers by a ratio of 5:1, the most lopsided ratio since September 2022. Interestingly, while the percentage of loans trading above par declined 22 percentage points to 34% in February, par-plus trade activity fell just six percentage points to a 53% share of total activity. The fall-off would have been far worse if not for the strong showing of the mega deals that broke for trading. In turn, loans that were previously trading north of par, slipped into the 100 to 98 bid range, which swelled to a 23% share. On a brighter note, the sub-98 price range remained constant at a still bullish 24% share (as did the sub-90 range at 10%). As one trader put it in late February, “a bit of the froth was removed from the higher end of the secondary as opposed to a much broader risk-off mandate from portfolio managers”. March activity might suggest otherwise with the average bid level on the S&P/LSTA Leveraged Loan Index falling 75 basis points through March 19.