November 7, 2023 - It’s been well broadcast that by the end of the year about 40% of U.S. BSL CLOs will have exited their reinvestment periods (RPs), up from 15% at the end of 2022. On the one hand, this raises questions about demand for loans. (For some perspective, BofA Research shows that the 2023 reinvestment period cliff will reduce buying capacity by just $45 billion while year-to-date demand exceeds loan supply by $34 billion.) On the other, it poses challenges for equity investors looking to remain invested and managers trading within the confines of their indentures.

As one example, a post-RP world puts a manager’s ability to comply with the vehicle’s weighted average life (WAL) test – the metric that measures the average maturity of the loans held in the portfolio as a means of preventing a mismatch with the CLO’s liabilities – under the microscope. Because the WAL test shortens over time, the universe of loans that would meet the criteria the manager can purchase and, as a result extend optionality for equity holders, becomes significantly smaller.

With more CLOs out of their reinvestment period, there may be more competition among managers to source short-dated loans. Alongside the constraint of reinvesting in near-term maturities comes the potential for increasing risk in the portfolio, as loans with near-term maturities often are lower rated reflecting weak refinancing prospects. (Not to mention the increased risk/lower-rating pairing complicates compliance with other tests required by the structure.) To be sure, about 51% of loans in the Morningstar LSTA US Leveraged Loan Index maturing between now and 2025 are rated B- or lower. Any grab for short-dated paper could become increasingly challenging for WAL test compliance; after all, these short-dated credits may summarily exit through opportunistic refinancings and extension amendments and private credit continues to provide an alternate avenue for refinancing credits less palatable to the broadly syndicated market.

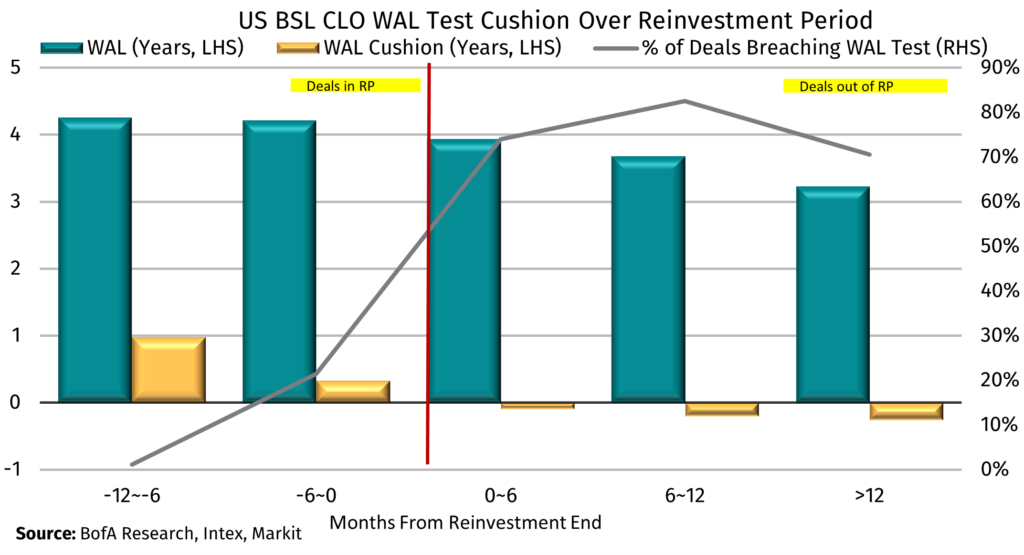

Vehicles approaching the end of their reinvestment period within six months have a WAL cushion of just 0.3 years, offering little flexibility – and 21% of that cohort are failing their WAL test, according to BofA Research. These levels deteriorate through the end of the reinvestment period and the accompanying contraction in the WAL test. Vehicles within six months of their RP-end have a WAL deficit of 0.1 years, and the deficit increases by 0.1 years in each subsequent six-month period, while the percentage breaching their test jumps to 74% in the first six months.