August 1, 2023 - We’re one month out from USD LIBOR cessation – and the world has remained relatively calm. (Indeed, this was echoed in the readout from the ARRC’s July 31st meeting.) Here is what we’ve heard and seen.

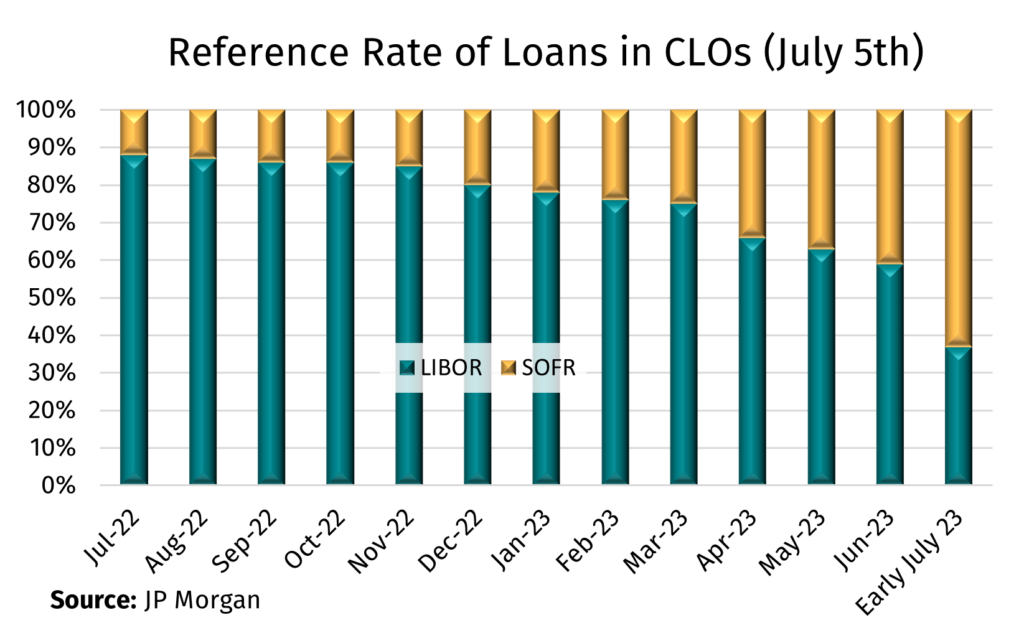

First, there was a material ramp up in LIBOR transition amendments between May and June (see slide 2 of this power point deck). In May, LevFin Insights publicly tracked 84 fallback amendments for leveraged loans; in June this more than doubled to 207. Thanks to the acceleration in fallback amendment activity, the share of loans referencing SOFR jumped by early July. According to JP Morgan (slide 3), the share of SOFR loans in CLOs hit 63% by early July, up from 41% a month earlier. And bear in mind these are just the loans referencing SOFR. Many of the loans still referencing LIBOR did transition when the FCA announced on July 3rd that LIBOR was no longer representative but these loans had locked in one more 1M or 3M (or 6M) LIBOR period tied to a June interest rate reset. We expect the share of SOFR loans to climb again when the early August data becomes available.

CLOs also have transitioned but, because many of them transitioned at the end of June and because they have three-month interest periods, many will reference LIBOR until late third quarter or fourth quarter this year. According to JP Morgan (slide 4), 23% of CLO liabilities were referencing SOFR as of June 27th. According to a large trustee, most CLOs did transition around the end of June – usually via “regular-way” hardwired fallbacks or manager selection, but a handful of CLOs utilized the LIBOR Act to fall back. In nearly all cases, the CLO reference rate fell back from LIBOR to SOFR + 26 bps.

So, was it all smooth sailing as we ride off into the sunset?* We have heard from lenders that occasionally some notices from some agents are confusing. We encourage agents to include separate fields for i) reference rate (SOFR), ii) margin and iii) CSA in their interest rate notices. This way, lenders can have visibility into all the components of their interest rate. But if that is the biggest complaint we have one month after the end of panel LIBOR, we’ll take it!

*Wildly mixed metaphor intended