March 2, 2023 - The FT recently commented that, as LIBOR deadline looms, leveraged borrowers and lenders are “scrapping over the fine print as the deadline approaches.” But is there really a systemic issue or are markets just being…markets? While the LSTA strongly (!) encourages members to remediate before LIBOR cessation, we also want to ensure that the “loans are late” narrative captures all the nuances of remediation. And so, we recap the state of play below.

JPM reported that as of February 2nd 17% of CLO floating rate liabilities and 26% of the JPM Loan Index referenced SOFR. Considering the size of these markets, these relatively low shares of SOFR contracts might be concerning. But there are mitigants. First, it’s not necessarily that the loan and CLO markets are falling back late, it may be more that they are not falling back early. Nearly every syndicated loan and CLO has fallback language and thus will transition to something when LIBOR ceases. In addition, even those lacking formal fallback language have a place to go (Prime or synthetic LIBOR for elderly loans without fallback language, LIBOR Act for ancient CLOs without workable fallbacks).

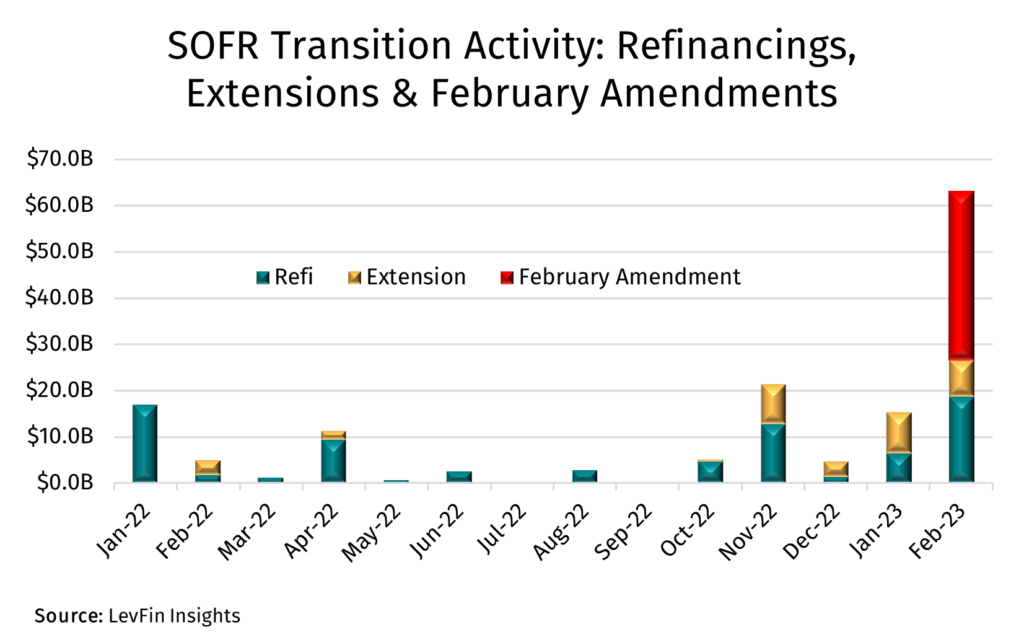

Moreover, the switch to SOFR is accelerating. This week LevFin Insights recapped February’s remediation efforts. As the COW illustrates, there was a substantial jump in both refinancings/loan extensions (which force a switch to SOFR) as well as LIBOR fallback amendments. All told, more than $60 billion of leveraged loans were observed switching to SOFR last month. What of the much-discussed contentious credit spread adjustment (“CSA”) negotiations? As background, the ARRC CSAs (11/26/43 bps) represent the five-year historical median difference between LIBOR and SOFR as set in March 2021. This is the methodology proposed by the ARRC (and affirmed in multiple market consultations) to minimize the long-term value transfer between parties. However, they are only guaranteed in ARRC hardwired fallbacks. It is important that market participants know whether their loan agreements have ARRC hardwired or negotiated amendment fallbacks. So how have fallback negotiations played out? As illustrated on slide 6 of a recent LSTA presentation, most of February’s fallback amendments used a 10 bps CSA. That suggests to us that, while it might not be elegant, market negotiations are working.