October 1, 2019 - So now everyone knows what SOFR (and Treasury repo) is!

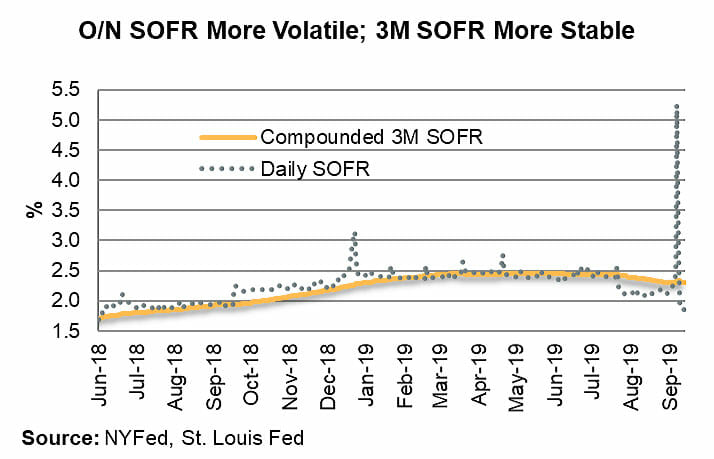

And now that we have your attention, let’s discuss SOFR. First, the COW demonstrates the behavior of overnight SOFR (can be volatile along with repo) vs. three-month SOFR (more stable). While overnight repo – and thus SOFR – can be volatile, no one is suggesting that borrowers lock in a one-day rate for a three-month lending period. Once a three-month period is used, the volatility eases.

While overnight repo – and thus SOFR – can be volatile, no one is suggesting that borrowers lock in a one-day rate for a three-month lending period. Once a three-month period is used, the volatility eases.

Second, while the Federal Reserve has been focusing on repo, the ARRC has been working on making SOFR more workable for cash products. Most folks know that SOFR is a different kind of rate and will require a “spread adjustment” to minimize the difference from LIBOR when LIBOR ceases. But how does one compute this spread differential? Both ISDA and the ARRC have published approaches, which we discuss below.

Let’s begin with some background (which SOFR aficionados can skip). First, a spread adjustment is meant to minimize the difference between LIBOR and SOFR when LIBOR ends, thus minimizing value transfer. ISDA has been consulting on spread adjustments for derivatives and respondents generally prefer a “historical mean-median” approach. In other words, what is the mean or median differential between LIBOR and SOFR (or its equivalent) over a historical period. Second, the ISDA spread adjustment may very well be sufficient for cash products, but the ARRC also has committed to recommend spread adjustments for cash products.

And so, in the Sept. 5, 2019 meeting minutes, the ARRC published a presentation that offered spread adjustment approaches – and results. The ARRC ran analyses using rolling cohorts of FRN data from 1999 to 2019 using Effective Fed Funds Rate (“EFFR”) as a proxy for SOFR. The ARRC then compared the actual “EFFR+spread adjustment” rates to the actual LIBOR rates on the FRNs.

The ARRC analyzed the spread adjustment using three “types” of EFFR: i) EFFR in Advance (analogous to SOFR Compounded in Advance), ii) EFFR in Arrears (analogous to SOFR Compounded in Arrears) and iii) Term EFFR (analogous to a SOFR term rate). It also used three types of spread adjustment: i) average, ii) trimmed mean (excluding the top and bottom 10% of observations) and iii) median. Finally, the ARRC tested three lookback (i.e., calculation) periods: i) two years, ii) five years and iii) 10 years.

The data are results are on page 10 and conclusions are on page 11, but we’ll recap them here. First, a longer lookback produces more accurate results. Second, the trimmed mean has a 9 bp mean average error, and is (slightly) more accurate than other rates. Third, the errors are pretty similar regardless of whether the “In Advance”, “In Arrears” or “Term” EFFR is used.

Importantly, the initial analysis compared spread adjustments including the very disruptive financial crisis period. When doing the same analysis in the post-crisis period, the errors fell by nearly half (p 13).

Finally, the ARRC tested the results using a transition period, which would effectively allow the spread adjustment to gradually be added to SOFR during the year following LIBOR cessation. This would avoid any “cliff-edge” changes in rates upon LIBOR cessation (good), but could add complexity (not as good).

While the ARRC is firming up potential cash spread adjustments, ISDA is getting close to publishing SOFR spread adjustments for derivatives. On September 18th, ISDA released its consultation on Final Parameters for Spread Adjustments. There are several salient points for cash market denizens. First, Bloomberg will publish the SOFR Compounded in Arrears rate, the spread adjustment and an “all-in” rate (e.g., SOFR plus spread adjustment). Second – and importantly! – it will publish an “indicative” numbers starting around year-end 2019, which means users soon will be able to see actual potential replacement rates. (These indicative numbers wouldn’t become the final static spread adjustments until LIBOR cessation.) Finally, ISDA is working on a solution for “pre-cessation” events, so that products that have a pre-cessation trigger (like loans) can also use a spread adjustment upon that trigger being executed.

So, between work of ISDA and the ARRC (and your local friendly trade associations), the SOFR transition hurdles should be shrinking.