January 18, 2023 - There are fewer than six months to go before the cessation of panel LIBOR on June 30, 2023. We hope that you – with your possible exposure to hundreds of LIBOR loans and dozens of CLO notes! – are ready. To aid in this readiness, the LSTA is actively adding to its suite of LIBOR transition resources.

Most recently, the LSTA’s Tess Virmani and Meredith Coffey recorded a video with Cadwalader’s Lary Stromfeld and Jeff Nagle that detailed where we stand with respect to LIBOR transition, whether synthetic LIBOR will ride in to save the day, how the LIBOR Act and Final Rule may fit into remediation plans, and how members might consider analyzing their credit agreements for remediation. We recap these issues below, but strongly encourage members to review this LIBOR video and slides; Q&A will take place at the next monthly LSTA LIBOR Call on January 30th.

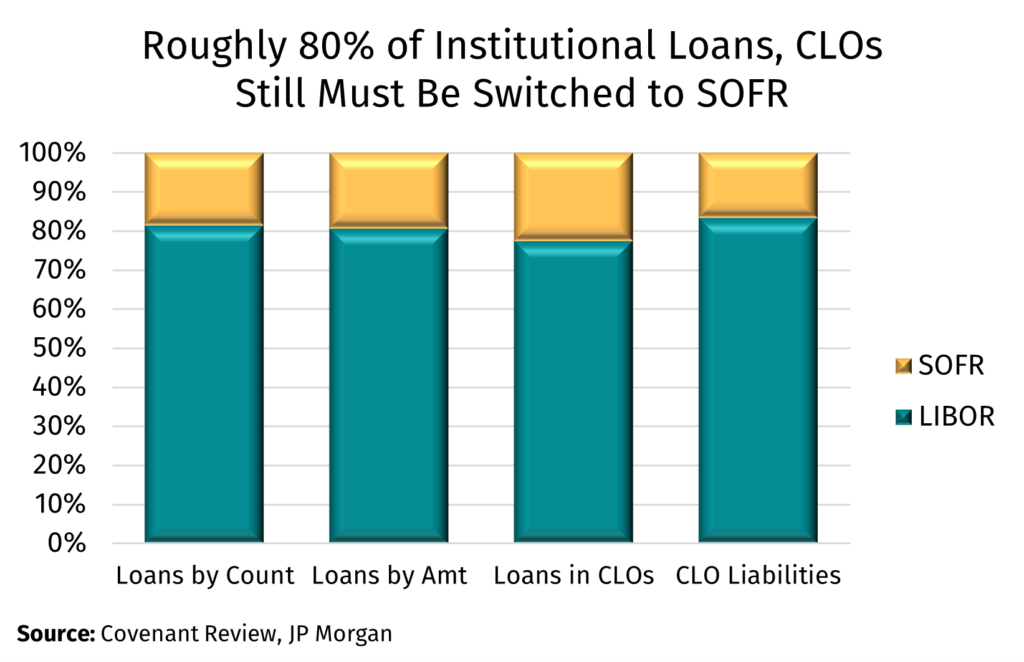

First, where do we stand? Way behind the curve! According to LevFin Insights and JP Morgan, approximately 80% of institutional loans and CLOs remain on LIBOR and need to transition in the next five-and-change months (see nearby chart and slide 4). In the loan space, LIBOR transition largely will be done via amendment; over half the LIBOR loans in the Credit Suisse Index have “amendment” fallback language. This amendment fallback language – which was agreed to at origination by all parties in the credit – generally was structured with >50% lender objection thresholds because widespread transition amendment failures could be a systemic risk. While the reduced lender threshold makes amendments easier to execute, it also means that lenders must watch the data room to ensure they are aware of amendments as they come up to have the opportunity to object if they so desire. The LSTA is preparing an advisory on LIBOR remediation amendment considerations.

We also looked to clarify the issue of CSAs on Slide 6. The ARRC CSA (11/26/43 bps) was developed for contracts falling back from LIBOR to SOFR and is directly applicable to loans with ARRC fallback language. As lenders no doubt know, some loans using other fallback language have used other CSAs such as 10 bps. Again, knowing your LIBOR fallback language (and watching the data room) is critical.

So, does synthetic LIBOR save the day? Unfortunately, as slide 3 lays out, probably not. First, while the UK’s FCA is consulting on its intention to publish a synthetic USD LIBOR through September 2024, that is not a done deal. Second, the number of syndicated loans that might be able to use synthetic LIBOR might be quite limited; any loan that has a direct or indirect “non-representativeness” LIBOR transition trigger likely would need to transition in the next few months. Ultimately, the best remediation plan is to plan to remediate now!

So how does one remediate right now? To be honest, for syndicated loans that path does not really go through the LIBOR Act. Cadwalader’s Lary Stromfeld and Jeff Nagle discussed what the LIBOR Act (and the Federal Reserve’s Final Rule implementing the Act) does – and does not – cover on slides 7 and 8. Slide 9 includes a particularly helpful LIBOR transition decision tree. While the Act may impact certain bilateral loans and legacy CLOs, syndicated loans will transition away from LIBOR in accordance with the terms in their credit agreements and the exact drafting is important! (see slide 10). For loans that simply fallback to Prime if LIBOR is not available, it will be important to understand whether the credit agreement will look to a synthetic USD LIBOR rate if one is published. For amendment approach fallbacks, members are reminded that there is significant variability in drafting and amendment fallback language evolved iteratively until the ARRC recommended language was broadly adopted at the end of 2019. For instance, the description of the replacement rate and credit spread adjustment and the market convention that might inform that selection should be an area of focus.

Review of legacy credit agreements to understand how the next several months will impact them is paramount and unavoidable. Market participants are encouraged to consult with counsel and review their remediation plans to determine whether the LIBOR Act or possibility of synthetic USD LIBOR means adjustments are needed.

Finally, while hardwired fallback language (present in 35% of the CS LLI) contains the substantive terms – when and with what LIBOR is replaced – technical changes to administer Term SOFR still are required. The scope of these unilateral amendments is defined in the fallback language and the LSTA has prepared a two-part form of Conforming Changes Amendment that can be used by administrative agents to implement these changes. The form of Conforming Changes amendment (together with the LSTA’s other forms of LIBOR remediation amendments) is available on the LSTA website.

There is little time and a lot of work to do – and this is a delicate and nuanced process. It behooves all members to educate themselves on the process and tackle it logically and rationally. A good place to start may be this video and the LSTA’s monthly LIBOR Q&A Call.