March 12, 2020 - It’s not pretty out there and the loan market is no exception. Still, jeremiads about loan defaults and knock-on effects on the economy may be premature. We discuss why below.

First, the un-pretty part: Loan mutual funds continue to suffer significant outflows, with Refinitiv/Lipper seeing $2 billion flowing out of weekly reporters this week. The selling (and general risk-off mentality) has driven the average loan bid in the S&P/LSTA Loan Index to 91 as of Wednesday, down almost six points from late January. And while nearly all loan prices have shifted down, Covid-impacted sectors are feeling more pain. Since mid-February, the average Oil & Gas loan price is down 13 points to 69, Air Transport (which includes American Airlines and United) has dropped seven points to a bit below 93, and Lodging/Casinos are down almost seven points to 92.5. Still, even the larger troubled sectors have relatively low market share: Oil & Gas and Retailers (average bid: 82) each comprise less than 4% of the Index.

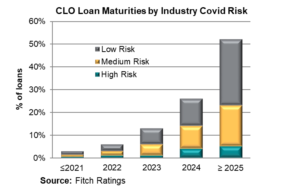

While sectors like Oil and Retailers are likely to experience continued pressure, Covid-19 is unlikely to drive a near-term jump in loan defaults. High yield energy default rates may top 10%, but Fitch believes there will be less impact in loans – and has not changed its YE 2020 loan default rate forecast of 3%. One reason for stabler loan default forecasts is that there just are not that many near-term maturities. The nearby chart cross-references the maturity profile of loans in CLOs against whether their sector faces face low, medium or high risks from the spread of Covid-19. As the Fitch chart demonstrates, less than 12% of the loans are in “high risk” industries – and less than 3% are high risk and have maturities before 2024. Thus, refinancing needs shouldn’t drive defaults.

But what about companies’ ability to pay interest? In fact, leveraged companies cost of borrowing is declining. In early December, three-month LIBOR was 1.9% and the contractual spread on loans in the S&P/LSTA Loan Index was 3.52%. Three-month LIBOR has since fallen to 0.77% and the Index loan spread is 3.45%. Thus, the typical loan “coupon” has fallen more than 100 bps, from 5.42% to 4.22%. In turn, any declines in EBITDA may be counterbalanced by lower actual interest costs.

Finally, companies also are taking action. As Refinitiv wrote, a number of companies in Covid-stressed sectors – such as United, Royal Caribbean and Norwegian Cruise Lines – have preemptively arranged new lines with their relationship banks. Others, like Boeing and Hilton, have drawn down their loans to ensure continued liquidity. Ultimately, Covid-19 is unsettling the market, but there are few signs that many borrowers being squeezed by maturities or are unable to pay interest.