February 7, 2024 - After rallying across the last two months of 2023, loans took a breather in January as the market digested a wave of repricings and refinancings sparked by strong investor demand, scant new lending, and the priciest secondary market since May 2022. According to the Morningstar LSTA Leveraged Loan Index (LLI), loans returned 0.68% in January, modest compared to the outsized performance across the last two months of 2023, when the expectation of a Fed pivot drove markets higher. January marked the third consecutive month that loan returns were positive, albeit below the average return of 0.89% over the last 12 months.

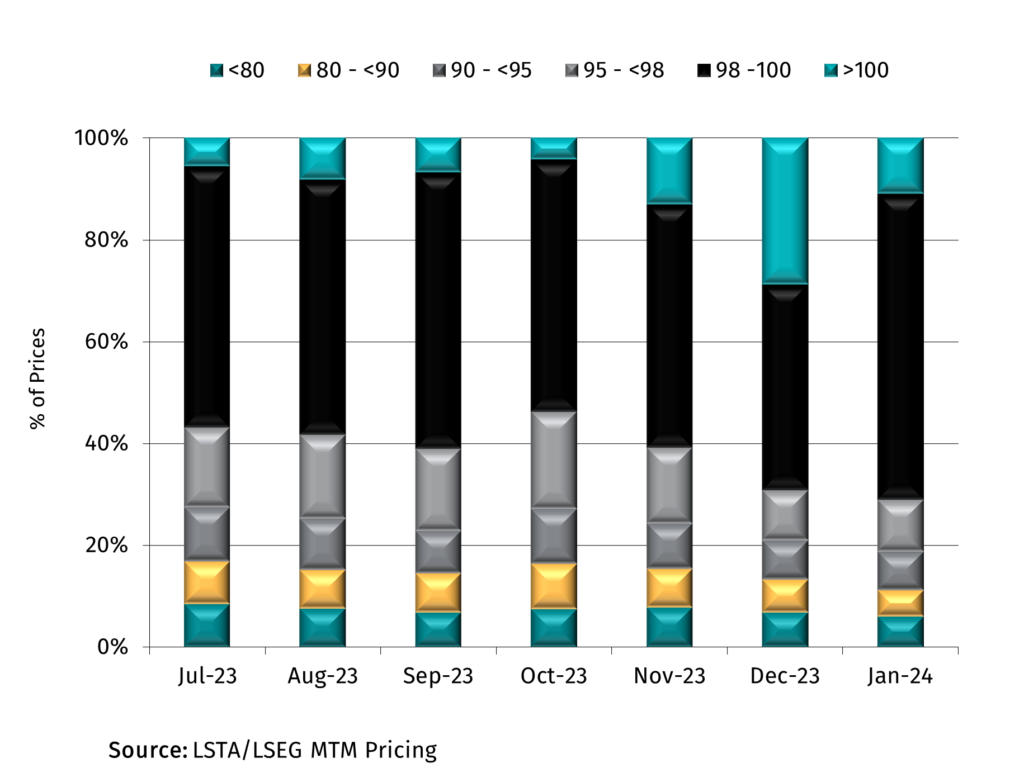

In the secondary market, prices advanced 15 basis points in the first half of January to a high of 96.38 before retreating to end the month at 96.27. The share of the secondary bid above par reached 31% in early January (its post-pandemic high), before declining to 11%, highlighting the pressure from the wave of repricings and refinancings. Nevertheless, the secondary remains well bid with 70% of loans marked at a bid of 98 or higher at the end of January. From another angle, prices in the secondary rose in nine out of 10 trading sessions between January 1 and 12 and declined in 10 of 13 days the rest of the month. The average bid-ask spread narrowed to 92 basis points.

In light of strong market conditions, borrowers in January took advantage of loans’ callability to cut interest expense. According to Pitchbook LCD, average spreads for institutional loans rated B+/B tightened in January to levels resembling 2021, or 31 basis points lower MoM to 367 basis points. The all-in yield, which includes the base rate and original issue discounts (OIDs), declined to 9.45% in the month, the lowest in over a year. Spreads tightened across high lending volume. LCD tracked $91.2B of repricings in January alongside $47.4B of refinancings, making it one of the busiest months on record. New money lending increased to $18.2B, the highest in four months, but it made up a meager 10.6% of overall institutional lending, below the 21% share new lending registered in full-year 2023.

Scant new money lending could not keep up with paydowns and the loan market (as measured by outstandings in the LLI) shrank $7.26B in January. Loan outstandings have declined for four consecutive months and 13 out of the last 16 months since the high point in 4Q22. New money lending was also insufficient to meet visible demand from investors.

At over one trillion in AUM, CLOs are the largest source of demand for loans, and they raced to start the year pricing 29 deals totaling $12.5B of new paper, making it the busiest January on record. After being rangebound for most of last year, liability spreads for BSL CLOs tightened to an average 161 basis points over SOFR, compared to 177 basis points in December.

Volume was complemented by $3.6B of reset volume, as CLO managers cope with the estimated 50% of deals scheduled to exit their reinvestment period in 1Q24, per BofA. Turning to retail demand, open-end loan mutual funds and ETFs registered $520M of inflows, according to LSEG Lipper. Combined visible demand from CLOs and retail funds and a decline in index outstandings pushed the market’s technical imbalance wider.

In a reversal from last year’s trend, the strength of the broadly syndicated market pulled transactions away from private credit, as borrowers and sponsors sought out the cheapest cost of funding (e.g. high-yield bond issuance jumped to $31B in January from $21B a year earlier). Looking at asset returns, after the huge rally across November and December, HY bonds were flat, with investment-grade bonds a touch lower (-0.17%), per Bloomberg Indices. The S&P500 reached a new high in January, returning 1.59%.