October 12, 2023 - Today, the LSTA hosted some 1,000 practitioners at its Annual Loan Market Conference. LSTA Executive Director Lee Shaiman kicked off the day warning about economic challenges – underscored by Dr. Marci Rossell’s keynote address – as well as an SEC that appears to have shifted into regulatory overdrive. But the world is not limited to loans, and the day also boasted two additional keynotes: Dr. Chris Miller (who literally wrote the book on Chip Wars) and Amy Webb (who discussed one of today’s most disruptive technologies – AI). Of course, audience enrichment aside, the day was primarily devoted to all aspects of lending. Below we recap the key takeaways and slides are available here.

We began in the markets, with the kickoff panel discussing a “higher for longer” rate cycle and its implications for leveraged finance. Panelists were quick to note that loans had already reaffirmed their ability to outperform in rising rate environments over the past 18 months – a trend that should continue into the new year as lenders and investors look to the loan market to manage duration risk. But despite the market’s outperformance this year, managing credit risk remains a challenge in 2024, particularly given the recent softness in the secondary market where sentiment recently shifted from bullish to bearish. Panelists contemplated the lower supply in 2023 but noted the many gains that borrowers had already achieved through a surge in repricings and amendments. While refis have outpaced sluggish M&A activity this year, last quarter acquisition finance hit its highest level since the Fed began raising rates. And the future is bright: Lenders expect a larger wave of new transactions in the new year.

Narrowing from a broad market overview, traders and technology providers drilled down into the secondary loan market. Panelists noted that the low level of loan supply this year, combined with retail fund outflows, impacted market liquidity. But then they pivoted to the future, e.g., electronic trading (meaning online loan trading that employs greater automation and technology). Panelists believe that the time is right for the electronification of loan trading with momentum from both market participants and dealers. They extolled the benefits of trading electronically, including pre-trade research and analytics better access to dealer quotes, and connectivity that will make trading more efficient and add liquidity. Complementing the technology developments is the growth of loan portfolio trading and optimization trades. The former is a transaction done as a package instead of a series of one-off trades, while the latter is a quantitative approach to portfolio management. Panelists explained that traders will benefit from these strategies and that these activities will lead to better execution from tighter bid-ask spreads.

Practitioners discussing the changing faces of the lender base agreed that recent market share trends in the institutional lender base will continue. These trends include CLOs remaining the primary driver of the broadly syndicated loan market and the share of funding sources that aren’t CLOs or loan funds – such as SMAs, commingled funds and insurance companies – contracting further as demand shifts to private credit. To the latter point, the panelists expect the near-term maturity wall of weaker broadly syndicated credits may be absorbed by private credit, shrinking BSL supply. On CLOs exiting their reinvestment period, the panelists affirmed that CLO managers and equity investors will consider all their options, including resets and refis, providing a floor for demand. (They also noted that the end of the RP doesn’t mean that a CLO can really no longer reinvest.) They also clarified that the atypical technical environment in this rate hike cycle (i.e., recurring fund outflows) is symptomatic of the pace of the Fed’s moves and the accompanying recession narrative that led retail investors to avoid credit risk.

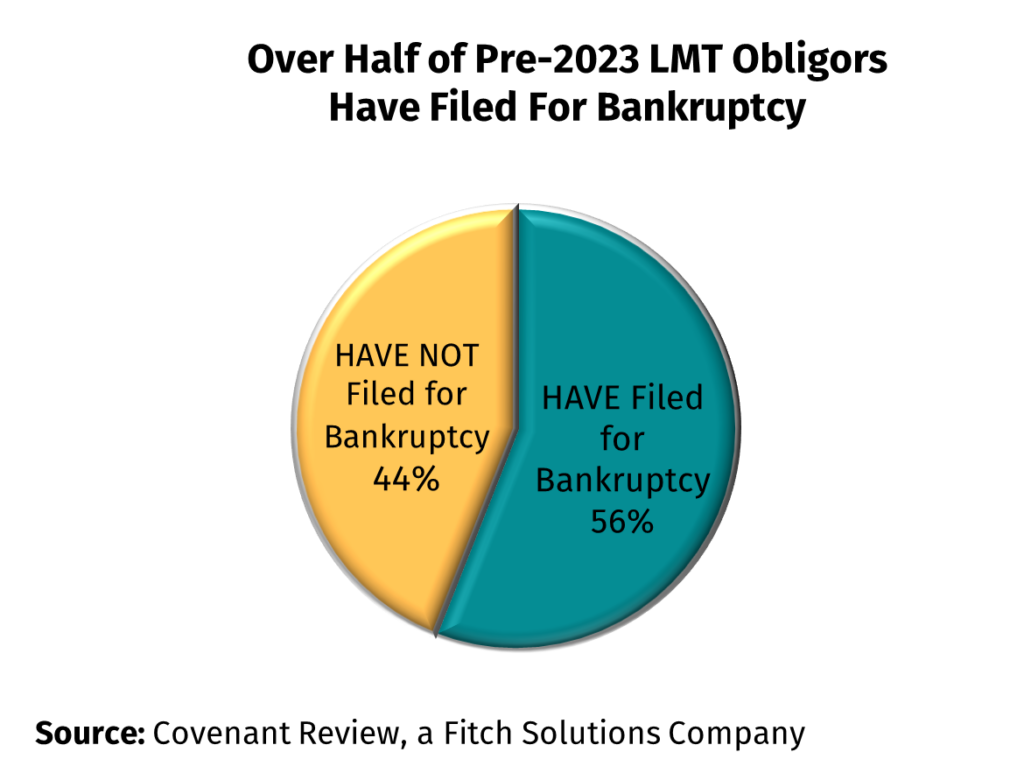

Moving from markets to credit, panelists discussing defaults, recovery and liability management transactions (LMTs) noted that LMTs are all the rage today. But, rage aside, how impactful are they? Covenant Review tracked the outcomes of 43 LMTs executed since 2014. It’s been rough. If we focus on “seasoned” LMTs done prior to 2023, over half the companies ended up filing for bankruptcy. But does the outcome of these LMTs fundamentally alter loans’ risk-return promise? Fitch calculated that 62% of institutional loans have the “Serta Uptier Loophole” and, based on historical data, the recovery for a primed loan is 23 percentage points lower than the historical weighted average recovery. If we assume 4% default rates for the next two years – around Fitch’s baseline – credit loss is increased by 114 bps or 57 bps a year. However, margins on outstanding loans in the CS Index are roughly 100 bps higher than those in pre-GFC days when documents were more protective. While it’s an open debate on whether 100 bps is a reasonable trade-off for weaker docs and lower ratings, lenders added that they are developing strategies to make LMTs less risky. Cases in point? CLOs can now participate in uptiering transactions, while portfolio managers are trading around documentation language and organizing more proactively.

Against the backdrop of the sobering statistics of the primary loan market presented earlier, the Legal Perspectives panel expanded insights from borrowers/sponsors on the one hand, and lenders on the other. Although borrowers may not be obtaining the types of friendly terms of the recent past, when compared to historical deals, today’s terms would still be considered borrower friendly. Private credit is still gaining an increasing share of the loan market, and recurring-revenue loans, amend and extends and covenant-relief amendments were also common in the first part of the year. Borrowers continue to seek flexibility. Thus, in addition to the drop-down and uptiering transactions, a third type of liability-management transaction has emerged this year – the double dip. In this LMT, the lenders have the benefit of a direct guaranty claim against the company and an indirect intercompany claim.

No loan conference is complete without a discussion of regulatory and operational challenges, and today was no exception. First up, regulation. Despite the recent successes of Kirschner (loans are not securities!) and the CLO exemption from the Private Fund Advisers Final Rule, the session barely had time to cover the panoply of proposed and final rules facing loan market participants. Not a single corner of leveraged lending or its participants has been left untouched by the spate of regulation: from the impracticality of the Safeguarding Advisory Client Assets proposal to the challenges that would be imposed by the Prohibition Against Conflicts of Interest in Certain Securitizations; from the costly and impactful new rules for private fund advisers to the SEC’s skepticism of open-end loan funds evident in the Open-End Fund Liquidity Risk Management and Swing Pricing proposed amendments. The panel explored the many practical implications for tomorrow’s loan market, but also reflected on the cumulative (negative!) impact of numerous concurrent rulemakings.

These regulatory proposals will significantly impact loan market operations if the proposed rules are finalized as written, operations specialists confirmed. For one, investment managers already perform oversight on outsourced functions while smaller outsourced providers and start-up companies would be disproportionately impacted. Meanwhile, reclassifying loans as Illiquid Investments will be unsustainable for open-end loan funds, which can only hold 15% of illiquid investments. Even if – a big if! – we are successful in defending open-end loan funds, we will need to support expedited settlement arrangements – and all parties will need to prepare documentation, processes and systems. Meanwhile, the safeguarding proposal would impose impractical protocols and significant costs on advisors (which likely would be passed on to clients) by requiring an independent public accountant to verify each trade as it occurs. Given current tools and procedures, this would not substantially decrease risk, nor would it create any value for investors. But it will absorb Ops’ time!

Ops specialists discussed in a second panel the many benefits of digital connectivity across administrative agents, lenders and service providers, along with the critical need for interoperability across sell-side and buy-side systems. All agreed that it is difficult for banks and the buy-side to consume data based on individual solutions and that vendor solutions will help to drive capabilities. Therefore, they announced the launch of a new LSTA technology sub-committee to focus on developing standard messaging formats and protocols, available to all vendors and loan market participants, to allow for real-time straight through processing. With the industry unified behind Versana and vendors excited to work together to create the same playbook, the loan market is ready to be transformed through real-time digital data. With movement to the cloud, data consumption will be easier. A workstream to discuss data governance will be included. Be assured, this will not be business as usual.

It was a wonderful day and the LSTA conference could not have happened without our wonderful sponsors. A heartfelt thank you to Fitch, Morningstar, Pitchbook, Refinitiv, S&P Global, Alter Domus, Broadridge, AFS, Allvue, ComputerShare, CUSIP, Delaware Trust, Deutsche Bank, Ernst & Young, Finastra, Glas, Hogan Lovells, LendOS, Octaura, Reorg, Sia Partners, Solve, SRS Acquoim, SS&C Advent, U.S. Bank, Versana, Wilmington Trust, Allen & Overy, Alston & Bird, Ashurt, DLA Piper, Egan Jones, Freshfields, Hashlynx, Katten Muchin, Kirkland & Ellis, Seward & Kissel, Sidley Austin and Wilmer Hale.