June 8, 2017 - This week, the LSTA hosted its Tokyo and Hong Kong loan investor conferences, welcoming more than 400 and 250 attendees, respectively. While the LSTA is a U.S. organization, we focused on global trends. Case in point: The kick off panel compared and contrasted the U.S. and Europe. The two geographies see many similar pressures. On the fundamental side, both regions enjoy sub-2% default rates. On the technical side, supply – as measured by the size of the U.S. and European loan indexes – has been relatively flat for several years. Demand, meanwhile, has been very strong, leading to high secondary loan prices (both regions are seeing 70% of loans bid above par), falling new issue yields, and softening structures and documents. But there are differences as well. For one, volatility is lower in Europe. This can be a good or bad thing. For instance, in the last four years, U.S. loan returns have ranged from –0.69% in 2015 to +10% in 2016. In the same period, the European loan index has returned 4-6%.

But volatility could soon rise everywhere. Speakers warned that a storm might be brewing as the Fed prepares to raise rates further and shrink its balance sheet. The good news is that loans may be a port in this storm. Being floating rate and low duration, loans should do well as rates rise. Being senior secured (albeit with less subordination than in prior cycles), loans should outperform if default rates climb. In contrast, HY bonds are fixed rate, high duration assets, so may be pressured by rate rises. They also are rich today, with the average price in the BAML U.S. High Yield Index above 102, as compared to 98.3 in the U.S. loan index. In turn, loan spreads are actually higher than swapped high yield bond spreads.

But even with loans looking good from a relative value perspective, it still may be time to take risk off, panelists said. As yields between riskier and less risky assets have narrowed, the smarter trade may be to buy higher quality assets and cede the marginal return today.

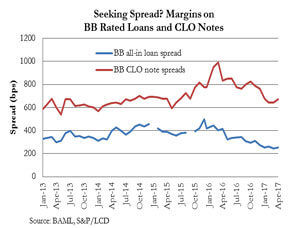

How else to prepare for volatility as the Fed trims its balance sheet? Long-term, non-mark-to-market, match-funded CLOs could be a good place to ride out a storm, other panelists added. Not only will CLOs not be sellers into a softening market, but they should be opportunistic buyers. Moreover, even if default rates rise, CLO debt tranches should see much lower loss rates than on the underlying loans. (Do note – as the LSTA Chart of the Week does – that CLO debt also enjoys far higher spreads compared with loans with equivalent ratings.)  And there should be continuing opportunity to invest in CLOs. At $40 billion, new CLO formation has been solid thus far in 2017. Even so, CLO issuance has been trumped by refinancings ($65 billion) and resets ($26 billion). Resets may overtake refinancings in the coming months as fewer CLOs fit within the constraints of the Crescent No Action Relief letter. Moreover, many equity investors and managers – at least those with the capital for risk retention – may prefer to do a reset so that they can extend a CLO’s reinvestment period as well as reduce spreads. This positions them to weather any volatility that may come.

And there should be continuing opportunity to invest in CLOs. At $40 billion, new CLO formation has been solid thus far in 2017. Even so, CLO issuance has been trumped by refinancings ($65 billion) and resets ($26 billion). Resets may overtake refinancings in the coming months as fewer CLOs fit within the constraints of the Crescent No Action Relief letter. Moreover, many equity investors and managers – at least those with the capital for risk retention – may prefer to do a reset so that they can extend a CLO’s reinvestment period as well as reduce spreads. This positions them to weather any volatility that may come.

So, the big takeaways from Asia: In preparation for coming volatility, buckle up, move toward floating rate and the top of the capital structure, and be ready to ride it out in a long-term non-mark-to-market vehicle.

The presentations from Tokyo and Hong Kong are available here and here. The LSTA would like to thank sponsors and speakers that traveled to Asia, including Alcentra, Ares, BAML, Barings, Blackrock, BNP Paribas, Credit Suisse Asset Management, Deutsche Bank, Eaton Vance, Goldentree, Golub Capital, GSO, Highland Capital, Invesco, InvestCorp, LCM, Marathon, Marble Point, Morgan Stanley, MUFG, Nomura, Octagon, Pinebridge, Shenkman, SuMi Trust, Symphony, Voya, S&P, Cortland, Fitch and IHS Markit.