February 24, 2022 - There’s no question but that Covid-19 was a massive stress test on the global financial system, not to mention the globe itself. The not-horrible news? Markets snapped back quickly, defaults did not spike as much as anticipated and credit quality has steadied. And the government, via the Shared National Credit (SNC) Review, recently agreed – albeit with caveats. Below, we recap the SNC data (which reviews loans originated before June 30, 2021) and compare it to what we’ve seen in the market.

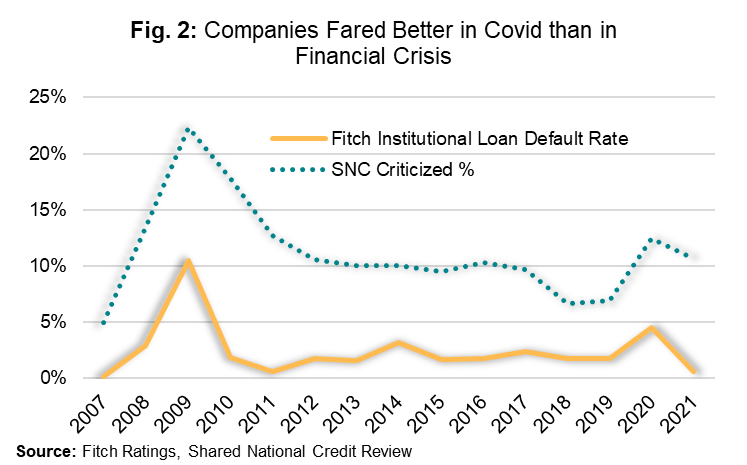

We’ll begin with a definition, detour into the obvious and perhaps meander into the absurd. Leveraged loans comprise roughly half the SNC dataset – but these are not leveraged loans as you know them. In earlier SNCs and Leveraged Lending Guidance, the regulators encouraged banks to include loans in the “leveraged” category if their total leverage exceeded 4x or senior leverage exceeded 3x, even if they had an investment grade rating. As a result, banks shifted many investment grade loans into their leveraged books. SNC, consequently, tracks a whole category of “investment grade leveraged loans”. As Fig. 1 illustrates, banks largely hold these IG leveraged loans and also are large holders of non-investment grade leveraged revolvers. “Other investors”, unsurprisingly, hold the bulk of “non-investment grade leveraged term loans”.

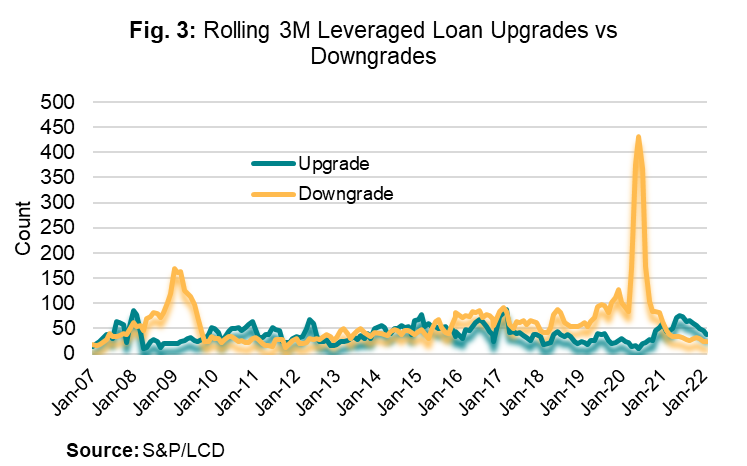

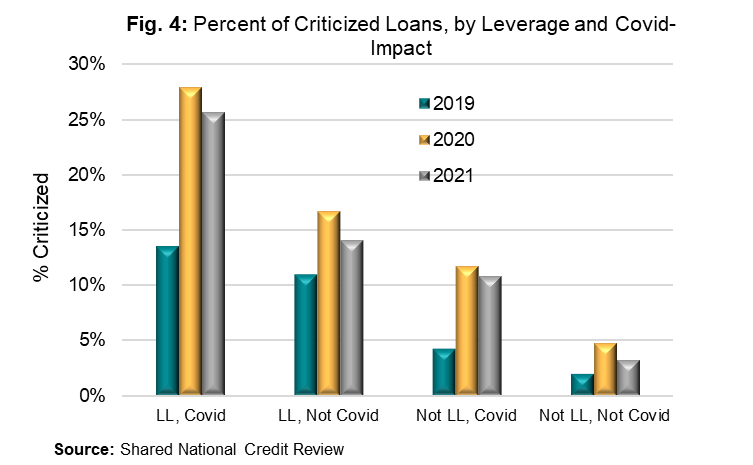

With those definitional oddities addressed, SNC moved on to performance in the pandemic. Covid-19 was easier on companies and the loan market than either the financial crisis or what we expected. As Fig. 2 demonstrates, in the financial crisis, SNC’s share of criticized loans (those classified as Special Mention, Substandard, Doubtful or Loss) jumped past 20% of the SNC portfolio. Meanwhile, Fitch’s Institutional Loan Default Rate climbed to 10%. In contrast, in the pandemic, SNC criticized loans increased to 12%, while Fitch’s default rate peaked at 4.5%. In the intervening year, criticized loans have edged down to 11%, while the default rate plummeted to 0.6%, near record lows. (Fig. 3 flags one place bucks the trend: rating agencies downgraded at a much faster pace than in the financial crisis. However, defaults did not parallel the downgrade trajectory.)

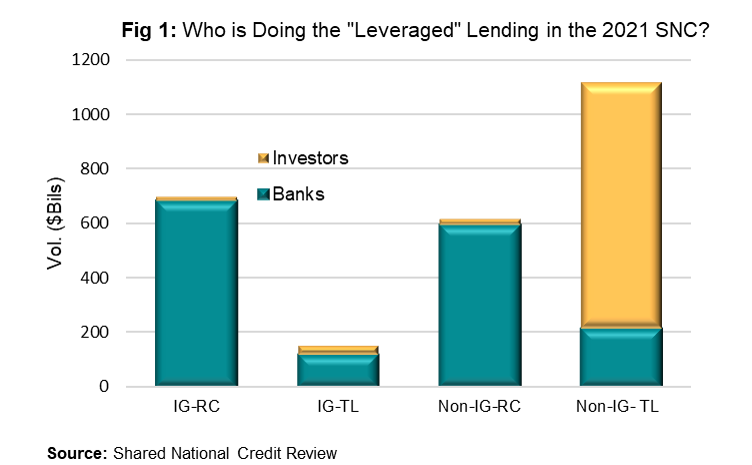

This is not to say that loans are the Teflon market. First, government relief programs – though they did not directly target leveraged borrowers and loans – buoyed markets overall and aided the snap back. Second, leveraged companies were, of course, harder hit than their investment grade counterparts. To assess the impact of the pandemic, SNC divided its universe into four categories: 1) Leveraged Loans to Covid-Impacted Companies (“LL, Covid”), 2) Leveraged Loans to Non-Covid-Impacted Companies (“LL, Not Covid”), 3) Non-Leveraged Loans to Covid-Impacted Companies (“Not LL, Covid”) and 4) Non-Leveraged Loans to Non-Covid-Impacted Companies (“Not LL, Not Covid”). As Fig. 4 shows, in those carefree days of 2019, 13.5% of LL, Covid Companies were criticized; this is not dramatically higher than the 11% of LL, Not Covid Companies. Come into 2020, and the share of criticized loans jumped across the board. Unsurprisingly, the impact was most severe for the LL, Covid companies, whose criticized share spiked to 28%. Not LL, Covid companies also were impacted; however, because they presumably had the financial wherewithal to withstand the sudden downturn, their criticized share climbed “only” to 11.7%. All of this is common sense (but now has math behind it!). As companies have more leverage, their degrees of freedom to tolerate a severe exogenous shock is lower. But, as has been shown time and again – and most recently by the GAO in December 2020 – the fact that some leveraged companies might come under stress does not mean that they pose a systemic financial risk.