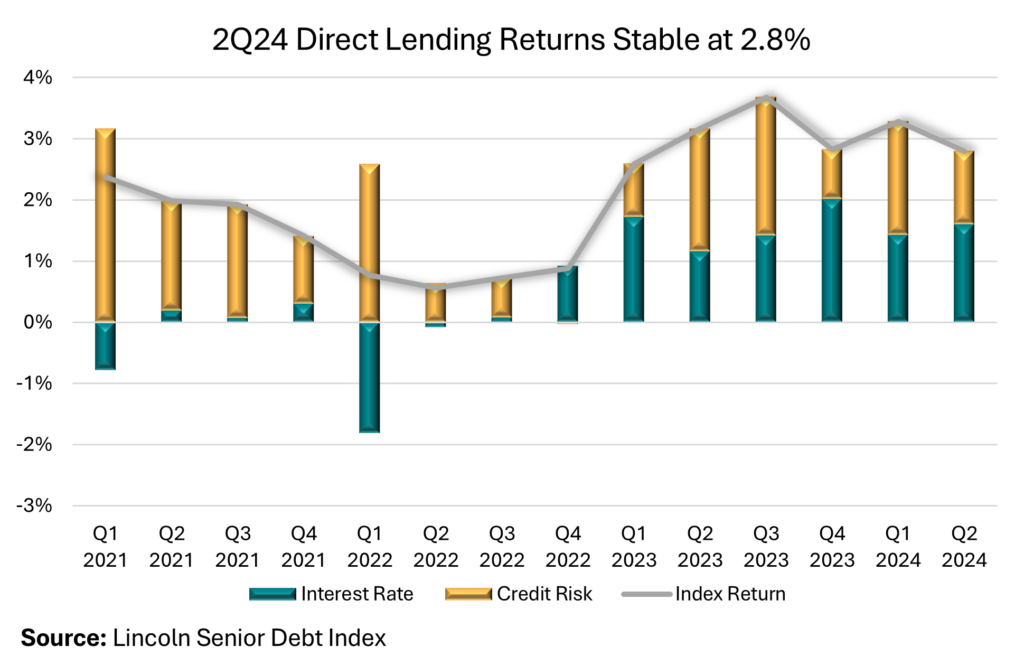

September 18, 2024 - Returns on U.S. direct lending loans declined 50 basis points to 2.8% in the second quarter, according to the Lincoln Senior Debt Index (LSDI). Returns remained ahead of broadly syndicated loans (BSL) for a second consecutive quarter, with the Morningstar LSTA Leveraged Loan Index (LLI) returning 1.9% in the quarter. As is characteristic of the asset class, direct lending returns have been stable over the last 18 months with high SOFR reference rates propelling returns. The yield for direct lending loans remained flat at 11.4% and again above the LSDI average of 9.8% since inception.

Looking closer at the drivers of performance, returns from interest income were 1.6% in 2Q, compared to 1.4% in the previous quarter and remained a source of stable income for investors over the last year and a half. This trend is similar to the trend in the BSL market, where high reference rates compensate for losses in the secondary market this year.

Of course, direct lending loans do not have a liquid secondary market, but are instead evaluated by firms like Lincoln International, which help managers asset the fair value of their portfolios. The LSDI is derived from the firm’s more than 5,500 quarterly assessments for approximately 175 asset manager clients. And in the second quarter, the LSDI’s fair value ticked up to 98.6%, from 98.4% in the previous quarter. Although fair value marks have climbed to the highest level since the second half of 2021, they have plateaued in 2Q compared to the previous year, again mirroring the trend in the BSL market.

While the aforementioned high reference rates have been a source of stress to borrowers, increasing defaults across leveraged corporate credit, the trend over the last five quarters has been of declining defaults in the LSDI. The index tracks covenant defaults and these declined to 2.6% in 2Q, from 2.7% the previous quarter and 3.4% in 4Q23. According to Lincoln, this trend demonstrates the close relationship between borrower and lender in the direct lending market and their ability proactively address any liquidity needs before they materialize. To wit, amendment activity remained high in the quarter with repricing amendments the most common observed by Lincoln, in addition to cash infusions from sponsors, maturity extensions and covenant holidays.

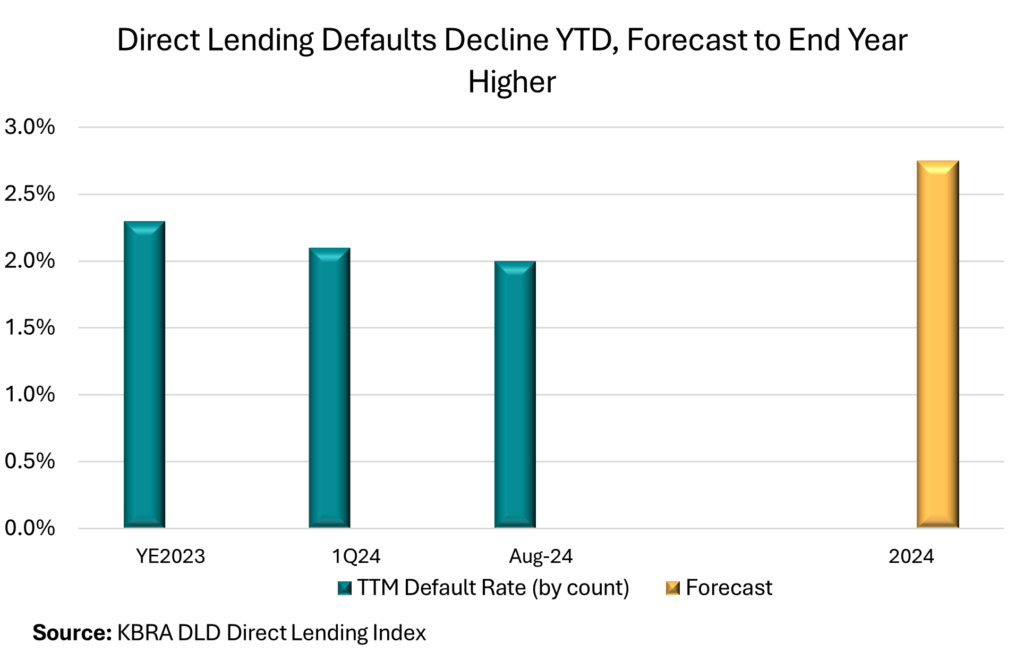

For a broader look at defaults, the KBRA DLD Direct Lending Index tracks bankruptcy, missed payments, distressed debt exchanges and restructurings in their default rate. Of the approximately 2,400 companies with direct lending loans tracked in the index, the 12-month default rate stands at 2%, by count, and is forecast to end the year at 2.75%. A total of 29 defaults have occurred so far this year compared to 38 over the same period last year, consistent with a mild and benign default environment. On the BSL side, the TTM default rate stands at 4.3% and is forecast to end the year in the 5% to 5.5% range, according to Fitch Ratings.