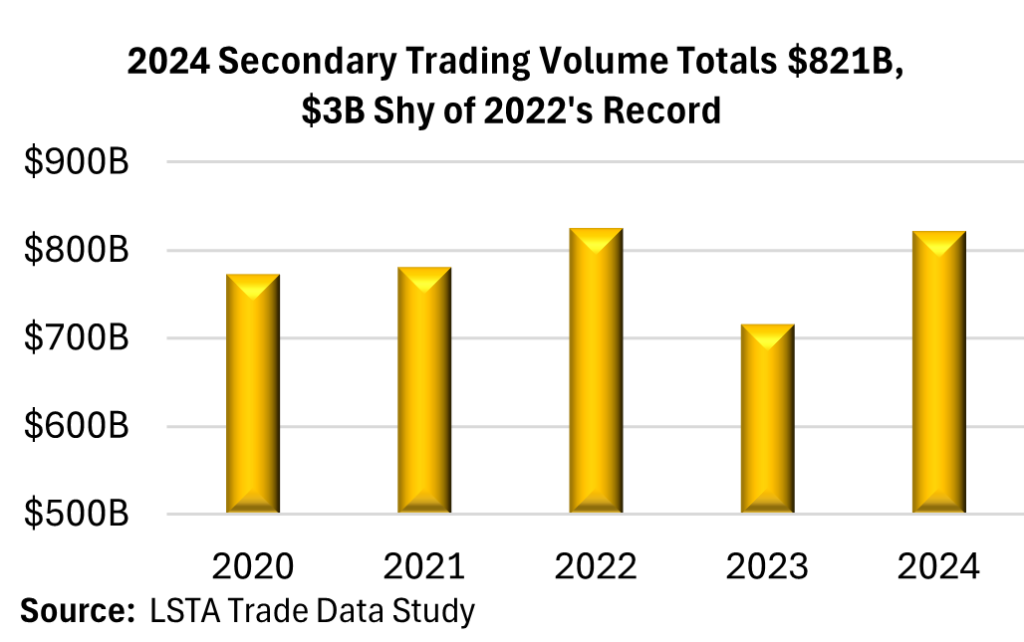

January 24, 2025 - 2024 LSTA annual secondary loan trading volume soared 15% to a near-record $821.4 billion, the largest year-over-year increase in a decade. 2023, though, was an off-year as volumes fell 13% to a six-year low of $715 billion. But back to 2024’s $821 billion in activity, which came in just $3 billion short of 2022’s record $824 billion, according to the LSTA’s 4Q24 Trade Data Study. Across 2024, average monthly and daily trading activity totaled $68.5B and $3.5 billion, respectively. In terms of market breadth, it was, in fact, a record year, with an average of 1,577 individual loans trading per month and 634 individual loans trading each day.

Price action in the secondary trading market was relatively contained from a historical perspective in 2024 as loans generally traded in a rather tight band. Back in January, the average trade price level stood at 96.25, its lowest reading on the year, before slowly increasing to a multi-year high of 97.97 in December. All told, the average trade price increased 160 basis points across 2024, while the median trade price rose above par in December (for the first time since 2018), equating to 120 basis point gain on the year. At the same time, “mark-to-market” bid-ask spreads tightened marginally with the median bid-ask spread on the traded universe of loans ending the year at 50 basis points, or 13 basis points tighter.

Most notable from a technical perspective, the monthly share of secondary trading activity at a price point north of par averaged 48% across the year, peaking in November and December at 55% and 62% respectively. As robust demand in the secondary fueled unprecedented primary market activity, total institutional lending volume jumped 2.5 times year-over-year to a record $1.4 trillion, according to Pitchbook LCD. However, the lion’s share of activity (82%) was in the form of repricings and refinancings as new deal remained limited. In some instances, borrowers were able to return to market more than once in 2024 to cut coupon levels – and they just may be back yet again in early 2025 given that spike in late 2024 par-plus trading activity mentioned above.

While strong demand for quality assets fueled trading activity on the upper end of the market (72% of volume transacted at a price point of 98 or better), the stressed side of secondary, or loans traded in a sub-90 context, totaled a manageable 12% share of trading activity across 2024. Even better, that figure fell below 10% over the last two months of the year. Furthermore, just 6% of trading activity transacted in a sub-80 context in 2024, down one percentage point from 2023. That said, even though traditional loan defaults (failure of payment and chapter filings) declined in 2024, overall defaults increased when including out of court liability management transactions (LMTs). These transactions pushed the LLI’s default rate (by count) to 4.7% in December, from 4% at the beginning of the year. From an LSTA trading document perspective, less than 2% of activity, or $14.4 billion of loans traded on distressed documentation.

As we move ahead into 2025, the floating rate loan market is well situated to outperform yet again in what is shaping up to be a higher-for-longer rate environment. Lenders have become increasingly confident that a lighter regulatory and business friendly environment will lead to a restart of the IPO market alongside higher M&A activity, which should support a pickup in new loan originations. While spreads are near their multi-year tights, expectations are for market technicals and fundamentals to remain supportive. That said, a pick-up in volatility across markets should be anticipated.