January 16, 2020 - According to recent research by Fitch, borrowers should have a compelling appetite for “hardwired” LIBOR fallbacks. The downside risk of the amendment fallback – ending up in Prime – may be more likely than borrowers appreciate and the cash flow and ratings implications could be material. We discuss all below.

Since last April, the loan market has had two templates for fallbacks for when LIBOR ceases: The amendment approach and the hardwired approach. The typical amendment approach states that i) when LIBOR ceases, ii) the borrower and agent identify a replacement rate (and spread adjustment), and iii) required lenders (typically 51%) have five days to object. If the required lenders reject the proposal, the loan goes to a Prime-based rate until a successful amendment goes through. The hardwired approach, which is used in all other markets, says that i) when LIBOR ceases, ii) the loan switches to a version of SOFR plus a spread adjustment. Thus far, loans have chosen the amendment approach. Covenant Review has tracked hundreds of new leveraged loans since 2018 and has not found one instance of a true hardwired fallback.

Why has the amendment approach been favored thus far? First, it does offer flexibility (for the borrower to choose the rate and lenders to reject it). Second, borrowers reputedly do not want to lock in a rate (SOFR) that is not yet clear (or not yet definitively the market standard). Third, lenders are cognizant that systems are not yet able to operationalize all variants of SOFR. However, these objections increasingly have been addressed: The Fed has published SOFR for more than year, ISDA will publish its spread adjustment in first quarter 2020, and practitioners have acknowledged that SOFR almost definitely is the route for the syndicated loan market.

Moreover, both lenders and borrowers should weigh the risks in staying in an amendment approach. First, it simply won’t be possible for all borrowers to get amendments done shortly after LIBOR cessation. Consider the numbers: LPC and Bloomberg, respectively, track 8,000 and 12,000 USD LIBOR loans that mature after 2021. Meanwhile, a whopping $1.13 trillion of the $1.19 trillion S&P/LSTA Leveraged Loan Index (LLI) matures after 2021. It will not be possible to amend all these loans in time to keep a large number from going to a Prime-based rate.

So what happens if many companies suddenly face (materially higher) Prime-based pricing? The answer, according to the Fitch report, is that a number would see significant FFO and cash flow coverage pressures. In fact, a number could face downgrades (and, presumably, borrowers get concerned with cash flow constraints well before a downgrade).

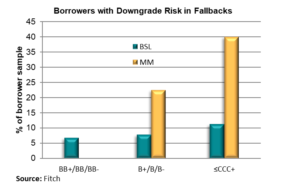

Fitch took 100 non-investment grade borrowers, evenly split between BSL and Middle Market, and replaced LIBOR with Prime at its historical average (5%). As the COW demonstrates, the higher interest costs put a number of borrowers at risk of downgrade. In the Middle Market sample, 36% of borrowers triggered at least one downgrade sensitivity test. In the BSL sample, 8% of borrowers triggered at least one downgrade sensitivity test. (The most commonly tripped test was FFO and fixed charge coverage.) As the COW also shows, lower rated companies are at higher risk for downgrades, particularly in the middle market.

Let’s take this initial research and apply it to what we know about the institutional loan market today. The Fitch data suggests that lower rated companies are more likely to be at downgrade risk. The LLI data shows a non-trivial shift toward lower ratings: In 2007, 55% of the LLI was rated BB- or better and 6% was rated B- or lower (but not defaulted). At year-end 2019, 38% of the LLI was rated BB- or better and the B- or lower share had climbed above 15%. This suggests that borrowers generally would be more sensitive to a rate increase. But, importantly, borrowers are more exposed to LIBOR-based debt today, as their preferences have shifted from bonds to loans. According to LCD, in 2007, new large corporate borrowers typically had total leverage of 4.9x and 80% of this came from (presumably LIBOR-based) first or second lien loans. In 2019, new borrowers had total leverage of 5.23x – and 90% came from first or second lien loans. Thus, there is more debt relative to cash flow and more of it is LIBOR-based. All of this suggests greater sensitivity to a switch from LIBOR to Prime.

So what can borrowers do? Go hardwired. The market has accepted that SOFR is the rate; there is visibility into the spread adjustment; there is a strong view that vendor systems can operationalize Compounded SOFR well before LIBOR cessation (and Simple SOFR in Arrears can be operationalized much faster). The downside risk of Prime should outweigh any perceived benefit of flexibility.