November 2, 2023 - It’s old news that everyone, everywhere is buzzing about private credit. The new news is the buzz about private credit CLOs. This was discussed extensively last week at ABS East – see any CLO analyst report, as well as a Pitchbook LCD update – and will be a key topic of conversation at the LSTA’s Tokyo Investor Conference in mid-November. But what do we really know about PC CLOs? Read on…

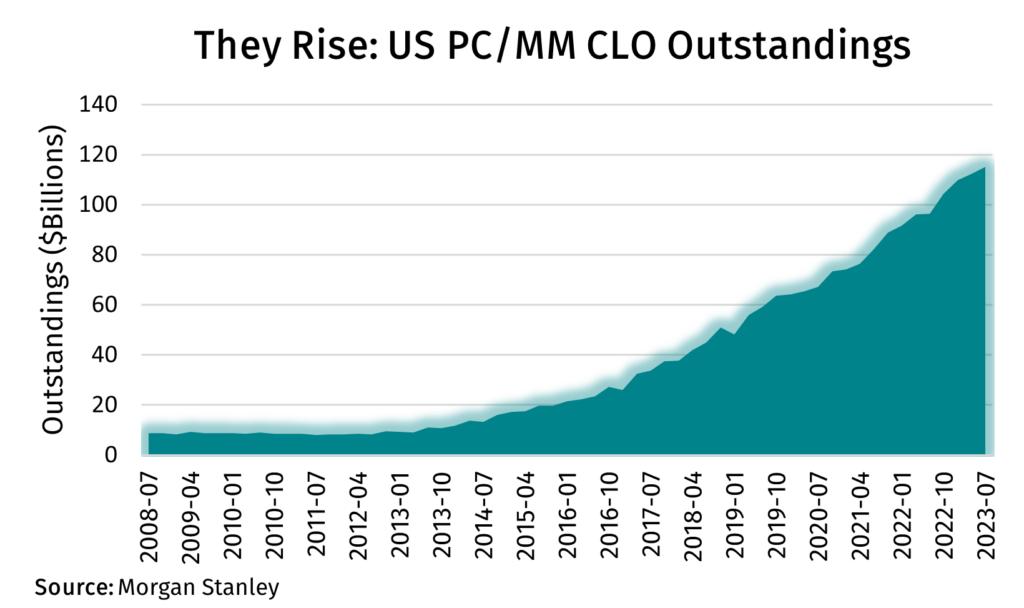

Foundationally, like private credit itself, PC CLOs are growing rapidly per a recent Refinitiv LPC chart. With more than $21 billion of issuance through mid-October, according to BofA, PC CLOs have accounted for roughly 23% of total US CLO volume this year. And, as the COW demonstrates, outstandings have more than doubled since early-2019 and now sit close to $115 billion.

But like many things in life, PC CLOs have their strengths and weaknesses. In a recent publication, Morgan Stanley discussed what PC CLOs bring to the table – and what they do not. First, PC CLOs historically have been a “financing” mechanism for private credit managers, allowing them to free up balance sheet to lend more; in contrast BSL CLOs typically are arbitrage vehicles that offer third party CLO equity attractive returns based on the arbitrage between assets and liabilities. That said, there are rumblings that arbitrage PC CLOs may be in the works. Second, while the mechanics of the CLOs work similarly, their characteristics tend to be different. PC CLOs typically have far more subordination than BSL CLOs, meaning that there’s more debt (or equity) beneath each tranche. PC CLOs typically have roughly 13% equity vs less than 9% for BSL CLOs; PC CLO AAAs have about 45% debt and equity beneath them as compared to 38% for BSL CLOs. All this makes the PC CLO structure itself sturdier. From an investor perspective, PC CLOs offer a diversification play because these deals have less inter-manager collateral overlap (which makes sense considering that the manager often is originating the assets). Then there is the return. According to Morgan Stanley, PC CLO AAAs typically offer a 30-40 bps spread pick up relative to BSL CLOs (and, recall, the odds of a default on either type of AAA are microscopically small).

Of course, PC CLOs have their downsides as well. First, the obligors are smaller and are typically lower rated – the majority are credit estimates in the B- to CCC range. Second, since loans are typically smaller and private, there is less visibility into the portfolio than the radical transparency that the BSL CLO market offers. Third, because the managers often are originating the asset, there are fewer loans per CLO and hence the portfolio is less diversified. And, ultimately, there is less liquidity in both PC assets and liabilities; both trade significantly less frequently than their BSL counterparts.

Ultimately, there are arguments for both BSL and PC CLOs; we’ll discuss each in depth in the LSTA Tokyo Investor Conference – and we’ll offer analysis and takeaways from that event in several weeks.